Delhi High Court

Central Govt Employee Cannot Change Destination Midway While Claiming Leave Travel Concession: Delhi High Court

The Delhi High Court has made it clear that in terms of the Central Civil Services (Leave Travel Concession) Rules, 1988 an employee cannot change travel destination midway through the journey and if due to some unavoidable circumstance it has been changed, the same has to be a destination which is en route.In the case at hand, LTC was originally sought for travel to Trivandrum, which was subsequently changed to Goa, via Mumbai. However, the petitioner decided midway to change his destination to...

Delhi High Court Has Jurisdiction To Hear ANI's Copyright Infringement Suit Against OpenAI: Amicus Curiae

Amicus curiae Dr. Arul George Scaria on Friday told the Delhi High Court that it has the jurisdiction to hear the copyright infringement suit filed by Asian News International (ANI) against OpenAI Inc, which founded ChatGPT.Scaria is a Professor of Law at National Law School of India University. He submitted before Justice Amit Bansal that the Delhi High Court has the jurisdiction in the case primarily because ANI is based in Delhi and ChatGPT is used and accessed in India. He further said that...

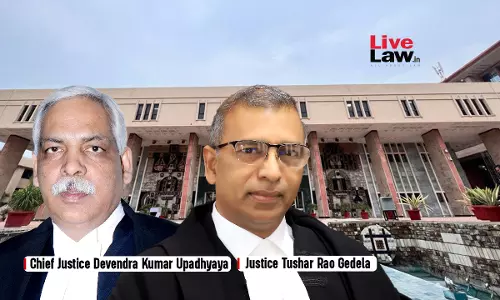

AO Becomes 'Functus Officio' After Closure Of Assessment, Must Put Relevant Incriminating Material To Assessee To Re-Confer Jurisdiction: Delhi HC

The Delhi High Court has made it clear that after the closure of assessment proceedings, the Assessing Officer becomes 'functus officio' and to re-confer jurisdiction upon the AO to initiate re-assessment proceedings, relevant incriminating material ought to be put to the assessee.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela made the observation while dealing with a writ petition filed by Vivo Mobiles, assailing the reassessment proceedings initiated...

Failure To Attach Impugned Arbitral Award Along With Section 34 Application Would Render Filing Non-Est: Delhi High Court

A full bench of Delhi High Court comprising of Justice Rekha Palli, Justice Navin Chawla and Justice Saurabh Banerjee while hearing a reference made by a single judge bench in Pragati Construction Consultants v. Union of India [FAO(OS)(COMM) 70/2024] held that if the party challenging an award u/s 34 of the A&C Act does not attach the impugned arbitral award with the Section 34 application, the filing will be considered "non-est." The Court further held that the filing of the ...

Mandate Of Serving Grounds Of Arrest In Writing Under UAPA Applies To Arrests From Date Of SC's Pankaj Bansal Ruling: Delhi High Court

The Delhi High Court on Thursday ruled that the mandate of serving grounds of arrest in writing to an arrestee under UAPA will apply to arrests from the date of pronouncement of Supreme Court ruling in Pankaj Bansal case delivered on October 03, 2023, and not from the date of pronouncement of subsequent decision in Prabir Purkayastha case.“…..the ratio of Pankaj Bansal would apply to arrests under the UAPA and other criminal offences from the date of pronouncement of Pankaj Bansal (i.e.,...

Violates Public Trust Doctrine: Delhi HC Sets Aside Tribunal's Award Allowing RIL To Explore 'Migrated Gas' Without Express Permission

A Division Bench of the Delhi High Court, comprising of Justice Rekha Palli and Justice Saurabh Banerjee, while hearing an appeal under Section 37 of the A&C Act, set aside an arbitral award in favour of Reliance Industries Limited(RIL). The Court invoked the doctrine of 'public policy in India', 'public law' and 'Public Trust Doctrine' and observed that the findings of the Arbitral Tribunal (AT) which held that the RIL's breach of Production Sharing Contract (PSC) was not a material...

Income Tax Act | 'Fee For Technical Services' Means Transfer Of 'Specialised'/ 'Distinctive' Knowledge Or Skill By Service Provider: Delhi HC

The Delhi High Court has held that Fee for Technical Services (FTS) as contained under Section 9(1)(vii) of the Income Tax Act, 1961 is concerned with the transfer of 'distinctive', 'specialized' knowledge, skill, expertise and know-how by a service provider.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar thus observed that assistance provided by the assessee-respondent with respect to rules and regulations for clearance of customs frontiers is not 'specialised...

Delhi High Court Re-Affirms Discretion Of Arbitral Tribunal To Implead 'Non-Signatory' As 'Necessary Party' In Arbitration Proceedings

The Delhi High Court bench of Justice Subramonium Prasad has reaffirmed that an Arbitral Tribunal has the authority to implead non-signatories to an arbitration, provided they are deemed 'necessary parties' to the proceedings. The court was hearing an application u/s. 11(6) of the Arbitration and Conciliation Act for the appointment of Arbitrator to adjudicate disputes arising under a Standard Transportation agreement and Customs Clearing Agent agreement. The petitioner had impleaded...

Quashing Of Show Cause Notice On One Issue Doesn't Mean Other Demands Are Not Liable To Be Adjudicated: Delhi High Court

The Delhi High Court has made it clear that if a show cause notice is quashed by a higher authority on one issue, it doesn't mean that other issues raised in the SCN are not liable to be adjudicated.The observation was made by the bench of Justices Prathiba M. Singh and Dharmesh Sharma in a case where the SCN was quashed by another division bench of the High Court so far as the issue relating to duty on free supply of materials was concerned. However, the CESTAT proceeded to discharge the entire...

Customs Department Must Intimate Party About Disposal Of Confiscated Property Both Via Email And On Mobile: Delhi High Court

The Delhi High Court has held that the Customs Department must ensure that the intimation of disposal of detained or confiscated property is given to the concerned party both via email as also the mobile number.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma reasoned this will ensure that a party who succeeded in Court or Tribunal against the detention of the property is not deprived of their properties.The observation was made while dealing with a case where despite the order...

TPO's Role Is To Determine ALP Of International Transactions, Can't Act As AO To Probe Legitimacy Of Such Transactions: Delhi High Court

The Delhi High Court has made it clear that the role of a Transfer Pricing Officer is to conduct a transfer pricing analysis and determine the arm's length price of an assessee's international transaction and the TPO cannot act as an Assessing Officer to probe the legitimacy of such transactions.A division bench of Justices Vibhu Bakhru and Swarana Kanta Sharma observed, “It is necessary to bear in mind that there is a distinction between the functions of a TPO and an AO. The TPO is required to...