Kerala High Court

Kerala High Court Rejects Review Of Direction On KINFRA Lease Execution In Favour Of ALKARSF

The Kerala High Court has dismissed a delayed review petition, refusing to reopen its earlier order that allowed the Kerala Industrial Infrastructure Development Corporation (KINFRA) to consider execution of a lease in favour of ALKARSF Apparels Pvt. Ltd. A Division Bench of Justice Bechu Kurian Thomas and Justice C. Jayachandran held that no fraud or suppression of material facts was made out. The court also found that the review plea was an afterthought, raised only after an adverse decision...

Kerala High Court Upholds Order Against Detention Of Hindustan Coca-Cola's Goods In GST Dispute

The Kerala High Court has dismissed a writ appeal filed by the state tax authorities against Hindustan Coca Cola Private Limited over the detention of its goods during transit under the GST Act. The court held that the detention was not justified because the consignment was accompanied by all required documents. A Division Bench of Justice V.G. Arun and Justice Harisankar V. Menon said proceedings under Section 129 of the Central and State GST Acts were not called for in the facts of the...

Kerala HC Grants Interim Relief To Retired Union Bank Employees From GST On Group Health Insurance Premium

The Kerala High Court on Monday granted interim relief to retired employees and family pensioners of Union Bank of India. It directed the Union government, GST authorities, and Union Bank of India not to levy GST on health insurance premiums paid under the group medical insurance policy for the policy year 2025–26. A Division Bench of Justices V.G. Arun and Harisankar V. Menon passed the order while admitting a writ appeal against a Single Bench decision. The Bench said, “Till then, there...

Arbitrator Appointment Challenges Must Be Raised Before Tribunal, Not In Interim Appeals: Kerala High Court

The Kerala High Court has held that its role is limited when hearing an appeal against an interim order passed under the Arbitration and Conciliation Act. At this stage, the court cannot examine whether the arbitrator was properly appointed or has the authority to act. A Single Judge Bench of Justice S Manu said such objections must be raised before the arbitral tribunal itself. “Competency of the Arbitral Tribunal is a matter to be raised before the Tribunal by the party having a...

Kerala General Sales Tax Act | Once Limitation Lapses, Assessment Cannot Be Revived: Kerala High Court

The Kerala High Court has held that assessment proceedings initiated beyond the statutory limitation period under the Kerala General Sales Tax Act, 1963 (KGST Act), are unsustainable in law and liable to be set aside. Justice Harisankar V. Menon noted that the pre-assessment notice under Section 17(3) of the KGST Act was issued against Bharat Petroleum Corporation Ltd. for the assessment year 2007–08 only on August 25, 2017. The assessment order was passed later, on January 28, 2019. This was...

Employees Liable To Pay Tax Even If Employer Deducts TDS but Fails To Deposit It: Kerala High Court

Holding that employees cannot avoid their income tax liability merely because their employer deducted tax at source from their salaries but failed to deposit it with the Income Tax Department, the Kerala High Court has ruled that the statutory protection under Section 205 of the Income Tax Act applies only when the deducted tax is actually paid to the Central Government. A division bench of Justice A K Jayasankaran Nambiar and Justice Jobin Sebastian madethe ruling while dismissing writ...

No Substantive Review Maintainable Against Orders Appointing Arbitrators: Kerala High Court

The Kerala High Court has recently ruled that only limited procedural correction and not a substantive review is permissible of orders appointing or refusing to appoint an arbitrator under the Arbitration and Conciliation Act, 1996.A single-judge bench of Justice S Manu said the law on arbitration is a self-contained code and does not permit courts to reopen such orders on merits, as that would slow down arbitration instead of speeding it up. The court cautioned that allowing substantive review...

GST Exemption On Health Insurance Applies Only To Individual, Not Group Policies: Kerala High Court

The Kerala High Court has dismissed pleas by retired bank employees seeking GST exemption on group health insurance premiums, holding that a 2025 Central government notification limits the benefit to individual health insurance policies. A single-judge bench of Justice Ziyad Rahman A.A. said, “It is further clarified in the Explanation in the said notification that the said exemption shall apply to a contract of insurance where the insured is an individual or an individual and family of the...

Pre-Deposit For Filing SARFAESI Appeal Must Be Paid To Tribunal, Not Lending Bank: Kerala High Court

The Kerala High Court has clarified that the mandatory pre-deposit required to file an appeal under the SARFAESI Act must be paid to the Debts Recovery Appellate Tribunal and not to the lending bank. A Division Bench of Justice Anil K. Narendran and Justice Muralee Krishna S delivered the ruling while allowing an appeal filed by Kerala Gramin Bank, setting aside a single judge's order that had directed the borrower to deposit money with the bank itself in order to pursue its appeal before the...

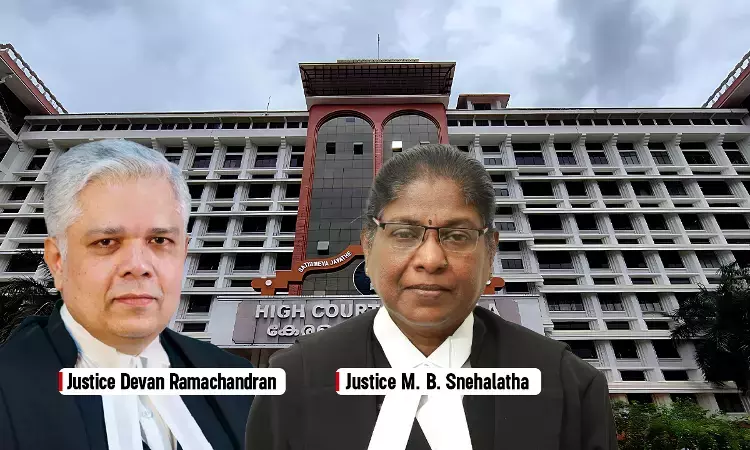

Kerala High Court Asks Centre To Decide Whether SNDP Yogam Is Governed By Companies Act Or Kerala NTC Act

The Kerala High Court, in a recent decision, directed the Union government to comply with a 2009 Delhi High Court order and decide if the Sree Narayana Dharma Paripalana Yogam (SNDP Yogam) is governed by the Companies Act or the Kerala Non-Trading Companies Act.The Division Bench comprising Justice Devan Ramachandran and Justice M.B. Snehalatha set aside the Single bench judgment, which had set aside a 1974 government order that granted exemption to the Yogam, a company registered under the 1882...

Dispute Arising From Sale Deeds Executed Between Partners As Part Of Business Arrangement Is Arbitrable: Kerala High Court

The Kerala High Court dismissed an appeal under Section 37 of the Arbitration and Conciliation Act, 1996 ("Arbitration Act") declining to interfere with an arbitral award dissolving a long-standing partnership and holding that the sale deeds executed between the partners were merely business arrangements, not intended to transfer or create title; consequently, the dispute did not fall outside the ambit of arbitrability, as it involved no rights in rem. A bench comprising Chief Justice...

Kerala High Court Tax Annual Digest 2025

Direct Tax[Income Tax] Assessing Officer Not Only An Adjudicator But Also An Investigator, Cannot Remain Oblivious To Claim Without Enquiry: Kerala HCCase Title: Cochin International Airport Ltd v. The Assistant Commissioner Of Income TaxCase Number: ITA NO. 77 OF 2018The Kerala High Court stated that the Income Tax Commissioner can exercise Revisional Jurisdiction under Section 263 of the Income Tax Act, 1961.The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that...