Himachal Pradesh High Court

No Statutory Mechanism To Revise GST Return For ITC: HP High Court Allows Manual Filing Of Monthly Return

In the absence of any statutory mechanism under the GST law to revise or correct GSTR-3B, the monthly GST return used to declare tax liability and claim Input Tax Credit, a taxpayer cannot be left without a remedy for a bona fide mistake, the Himachal Pradesh High Court has held. A division bench of Justices Vivek Singh Thakur and Romesh Verma allowed a registered taxpayer to file the GSTR-3B return manually for the quarter ending March 2021 so that its unclaimed Input Tax Credit (ITC) could be...

Himachal Pradesh High Court Quashes ₹16.72 Lakh GST Input Tax Credit Demand After Tax Is Paid

The Himachal Pradesh High Court has quashed a tax demand of Rs 16.72 lakh raised against Shivalik Containers Pvt. Ltd. for the alleged wrongful availment of Input Tax Credit (ITC).The court held that the subsequent payment of tax along with interest by the supplier cannot be ignored while examining the sustainability of a demand raised against the recipient, even if such compliance takes place after a delay of more than five years. A Division Bench of Justice Vivek Singh Thakur and Justice Jiya...

Plea Of Delay U/S 29A A&C Act Cannot Be Used Selectively By NHAI When Extensions Granted In Similar Land Acquisition Cases: HP High Court

The Himachal Pradesh High Court held that the National Highway Authority of India could not be permitted to raise the plea of delay and laches to defeat continuation of arbitral proceedings when extensions had already been granted and proceedings concluded in the cases of other similarly placed landowners. The court remarked that, having participated in the proceedings for almost nine years, NHAI could not invoke delay, particularly when the object of the Arbitration and Conciliation Act, 1996...

Income Tax Act | HP High Court Stays Reassessment Proceedings U/S 148 As Validity Of Notices Were Pending Before SC

The Himachal Pradesh High Court has stayed reassessment proceedings initiated against an assessee under Section 148 of the Income Tax Act, 1961, noting that the validity of such notices is already under consideration before the Supreme Court. A Division Bench comprising Justice Vivek Singh Thakur and Justice Romesh Verma passed the order while hearing a writ petition which had challenged a reassessment notice issued for Assessment Year 2017-18, on the ground that it was without...

Entry-Tax Interest & Penalty From Employer's Delay Cannot Be Shifted To Contractor In Arbitration: HP High Court

The Himachal Pradesh High Court has recently clarified that statutory interest and penalty arising from delayed payment of entry tax cannot be shifted onto a contractor when the delay was caused by the employer's own failure to act in time, and where the arbitral tribunal had consciously restricted the contractor's scope of liability. Justice Ajay Mohan Goel in an order dated December 29, 2025, dismissed a challenged filed by Himachal Pradesh State Electricity Board Ltd (HPSEBL) under...

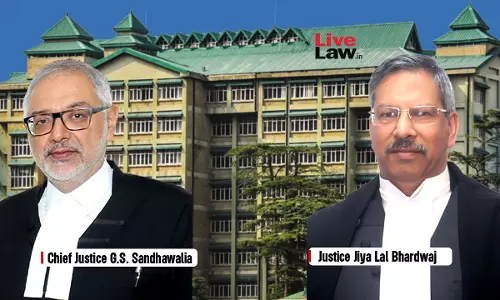

HP High Court Questions Shifting Of RERA Office From Shimla To Dharamshala; Interim Order Restraining Shift To Continue

The Himachal Pradesh High Court admitted a petition challenging the decision of the State Government to shift the Real Estate Regulatory Authority office from Shimla to Dharamshala.The Court remarked that RERA was a small institution with limited manpower and that the State ought to consider relocating larger offices instead of burdening a statutory authority with minimal staff.A Division Bench of Chief Justice G.S. Sandhawalia and Justice Jiya Lal Bhardwaj remarked that: “the interim order is...

Mere Interest In Project Does Not Justify Impleadment Of Non-Signatory In Arbitration Without Contractual Participation: HP High Court

The Himachal Pradesh High Court dismissed a writ petition holding that mere financial or consequential interest was insufficient to implead a non-signatory in the arbitration proceedings unless the stringent tests as laid down by the Supreme Court which include participation in the negotiation, performance or termination of contract were satisfied. Justice Ajay Mohan Goel observed: “Merely because the petitioner had a substantial interest in the subject matter of the contract, the same...

State & Union Failed To Enforce CSR Obligations After 2025 Rainfall Disaster: Himachal Pradesh High Court

The Himachal Pradesh High Court, while taking suo motu cognisance of the devastation caused by the excess rainfall in 2025, held that both the State Government and the Union of India failed to effectively enforce Corporate Social Responsibility obligations under the Companies Act, 2013. The Court noted that despite a clear statutory framework, no steps were taken to utilise the CSR funds for disaster relief and rehabilitation of infrastructure. Division Bench of Chief Justice G.S....

Central & State GST Authorities Must Coordinate To Avoid Multiple Adjudications On Same Issue: Himachal Pradesh High Court

The Himachal Pradesh High Court, applying the Supreme Court's Armour Security case, held that once proceedings are initiated by either the State or Central GST authority, parallel adjudicatory proceedings on the same issue are barred under Section 6(2)(b) of the CGST Act. The Court directed both authorities to coordinate and ensure that the assessee is not subjected to multiple adjudicatory processes on the same subject matter. Justices Vivek Singh Thakur and Sushil Kukreja examined...

Personal Criminal Liability Of Directors U/S 138 NI Act Survives Corporate Liquidation Under IBC: Himachal Pradesh High Court

The Himachal Pradesh High Court has reiterated that liquidation of a company under the IBC does not shield its directors from personal criminal liability in cheque bounce cases under Section 138 of the Negotiable Instruments Act, 1881(“N.I Act”) “15. ….Therefore, the orders passed by the learned Trial Court ordering the continuation of the proceedings against accused nos. 2 and 3 cannot be faulted.” Justice Rakesh Kainthla dismissed two petitions filed under Section 482 CrPC by...

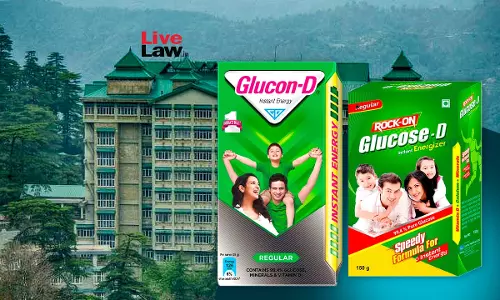

Himachal Pradesh High Court Denies Zydus Interim Relief In 'Glucon-D v Glucose-D' Trademark Case

The Himachal Pradesh High Court has recently refused to grant interim relief to Zydus Wellness Products Ltd., which had sought to restrain Leeford Healthcare Ltd. from using the marks “Glucose-D” and “Glucose-C” for its glucose-based products. A single bench of Justice Sandeep Sharma, in an order dated November 11, 2025, held that a company cannot claim exclusive rights over descriptive trade terms such as “glucose.”Zydus, which owns the registered trademarks “Glucon-D” and “Glucon-C,” argued...

Arbitral Award Without Corroboration Of Claim Certificate Patently Illegal: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when there is no appearance of a qualified person to corroborate the claim certificate, the arbitral award suffers patent illegality.A Division Bench of Chief Justice G.S. Sandhawalia and Justice Ranjan Sharma remarked that: “In the absence of corroboration of the certificate… and any qualified person putting in appearance, the award of ₹3.82 crore along with lease money is arbitrary and constitutes patent illegality.”The Court partly...