Rajasthan High Court

Condonation Must Be Considered Despite Deemed Service On GST Portal: Rajasthan HC Sets Aside Dismissal Of GST Appeal On Limitation

The Rajasthan High Court, in a matter concerning effective service of appellate order and consideration of condonation of delay application, has set aside order passed by the Appellate Authority. In a recent judgment a Division Bench comprising, Justice Pushpendra Singh Bhati and Justice Sanjeet Purohit on dismissal of appeal on account of limitation, emphasized that condonation of delay application must be judiciously considered. The Rajasthan High Court allowed the writ petition while ...

Rajasthan High Court Rejects Bail To Payment Aggregator Facilitators In ₹95 Crore GST Evasion Via Online Gaming Transactions

The Rajasthan High Court rejected the bail application of the applicants accused of facilitating large-scale GST evasion through online gaming transactions. Justice Sameer Jain stated that bail should normally be granted for offences under section 132 of the CGST Act, unless extraordinary circumstances exist, and in the matter at hand, there is GST evasion of approximately Rs. 95 Crores, which shall have writ large effects on the economy of the country. In the case at hand, the...

Can Arrest Warrants Be Converted To Bailable Warrants In Serious Economic Offence Cases? Rajasthan High Court Refers To Larger Bench

The Rajasthan High Court has referred to a larger bench the question of whether arrest warrants can be converted to bailable warrants in serious economic offences under the provisions of the PMLA (Prevention of Money Laundering Act), Customs, CGST (Central Goods and Services Tax), as well as heinous offences punishable under Indian Penal Code/Bharatiya Nyaya Sanhita. Justice Anoop Kumar Dhand stated that, “creation of fake/non-existing Firms with an intent to pass on fake ITC on the...

District Court Can Hear Design Infringement Cases Unless Cancellation Is Sought : Rajasthan High Court

The Rajasthan High Court has recently held that District Courts are empowered to hear design infringement cases unless the opposing party formally seeks cancellation of the registered designs. The bench at Jaipur made this ruling while setting aside the transfer of three such cases filed by Jaipur-based carpet exporter S.N. Kapoor Export against Saraswati Global Ltd., another trader from the city.A Single Bench of Justice Sudesh Bansal delivered the judgment on October 9, 2025, clarifying that...

Voluntary GST Cancellation Not Grounds To Freeze Company's Bank Account: Rajasthan High Court

The Rajasthan High Court has directed the Bank of Baroda to de-freeze the account of the petitioner-company, allowing it to use it freely till finally deciding the company's representation, observing that the bank could not freeze the account merely because the company's GST registration was voluntarily cancelled.The bench of Justice Nupur Bhati was hearing a petition filed by a company trading in goods which were exempted from the Goods and Services Tax, whose application for...

Seizure Of ₹2 Crore, Gold Bar From Govt Officer's Home Can't Relate To Official Act; Sanction For Prosecution Not Needed: Rajasthan High Court

The Rajasthan High Court dismissed a public servant's plea booked in a corruption case who had challenged an order taking cognizance of offences under PMLA on the ground that no prior sanction was taken as per Section 218 BNSS.In doing so the court observed that there were over Rs 2 crore cash and a gold bar worth over Rs 60 Lakh seized from the petitioner's residence and the same cannot relate to any act allegedly committed in discharge of the public servant's duty; thus prior sanction for...

Rajasthan High Court Declares GAFTA London Award Enforceable As Decree; Reiterates Narrow Scope Of “Public Policy” U/S 48 Arbitration Act

The Rajasthan High Court dismissed objections against the enforcement of a foreign award raised by Raj Grow Impex LLP stating that the scope of interference is extremely narrow at the enforcement stage and that an award holder having won before both the tribunal and appellate tribunals should not be left to feel that he has won the battle but lost the war. Justice Anoop Kumar Dhand held that “since this Court in the scope of Section 48 is not entitled to examine merits of the foreign...

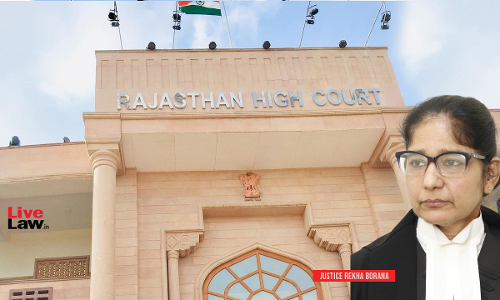

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification was later declared invalid. The writ petition being totally misconceived does not deserve any interference...

[Arbitration Act] Limitation For Filing S.11 Application To Be Calculated From Date Of S.21 Notice, Not From Date Of Dispute: Rajasthan HC

The Rajasthan High Court, Jaipur Bench, has held that the limitation for filing a Section 11 application under the A&C Act would be calculated from the date of serving the Section 21 notice to the other side and not from the date when the cause of action had arisen. The bench of Justice Anoop Kumar Dhand was hearing a Section 11 application praying for the appointment of an arbitrator to adjudicate the dispute between the parties arising out of the agreement dated 29.02.2016. ...

[Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court

The Rajasthan High Court Jaipur Bench has held that a Section 11 petition under the A&C Act without issuing the notice invoking arbitration (“NIA”) u/s 21 of the A&C Act would be maintainable if the Respondents were aware of the dispute being referred to arbitration. The bench noted that the Respondents were well-versed in the dispute raised by the Petitioner. They could not have been surprised after the Petitioner's plaint was returned by the trial court under Order VII Rule 10...

Income Tax | Rajasthan High Court Quashes Repeated Orders To Transfer Case, Calls Revenue's Approach 'Rigid' & 'Adamant'

The Rajasthan High Court has come down heavily on the Revenue Department for being “rigid and adamant” to transfer the case of the petitioner from Udaipur to Delhi under Section 127 of the Income Tax Act, 1961, despite the coordinate bench's earlier decision that quashed the same order.Section 127 of the Act empowers the income tax authorities to transfer a case from one Assessing officer to another to ensure better coordination, effective investigation or administrative convenience. The...

Rajasthan HC Grants One Month Extension For Filing Tax Audit Report After Complaints Of Glitches On E-Filing Portal

The Rajasthan High Court has extended the deadline for filing the Tax Audit Report by one month. A division bench of Justice (Dr.) Pushpendra Singh Bhati and Justice Bipin Gupta at the Rajasthan High Court extended the deadline under Section 44AB of the Income Tax Act, 1961, by 1 (one) month beyond September 30, 2025. It was submitted that in the previous years, CBDT had consistently granted such extensions in similar circumstances, and refusal to grant the same in the present...

![[Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court [Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court](https://www.livelaw.in/h-upload/2024/04/09/500x300_533108-rajasthan-high-court-jaipur-bench-1.webp)