Delhi High Court

Income Tax Rules | Centre's Power To Relax Conditions Under Rule 9C Exceptional & Discretionary, Not Ordinarily Subject To Judicial Review: Delhi HC

The Delhi High Court has made it clear that the power of the Central government to relax conditions prescribed under Rule 9C of the Income Tax Rules 1962, read with Section 72A of the Income Tax Act, 1962, is exceptional, discretionary and cannot ordinarily be subject to judicial review.In terms of Section 72A of the Act, the accumulated losses and unabsorbed depreciation of the amalgamated companies are deemed to be unabsorbed depreciation and losses of the amalgamated company for the previous...

S.36 Income Tax Act | Deduction For Bad Debt Allowed Only If Assessee Lends In Ordinary Course Of Banking/Money Lending Business: Delhi HC

The Delhi High Court has made it clear that allowance in respect of bad debts as an expense under Section 36 of the Income Tax Act, 1961, is permissible only if:(a) the debt was taken into account for computing the income of the assessee in the previous year in which the amount is written off or prior previous years; or (b) represents money lent in the ordinary course of business of banking or money lending.A division bench of Justices Vibhu Bakhru and Swarana Kanta Sharma thus set aside an ITAT...

S.29 CGST Act | SCN Must Reflect Both Reasons And Intent Of Retrospective Cancellation Of Registration: Delhi High Court

The Delhi High Court has made it clear that an order cancelling GST registration of a trader with retrospective effect will not sustain unless the show cause notice preceding such decision reflects both the reasons and the authority's intent for retrospective cancellation.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar observed, “in the absence of reasons having been assigned in the original SCN in support of a proposed retrospective cancellation as well as a failure...

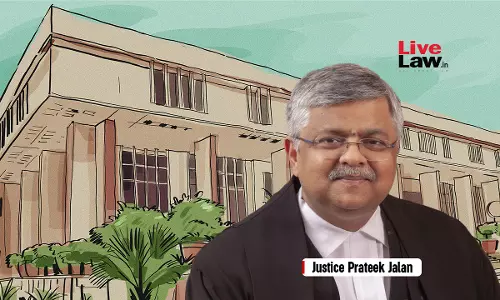

Arbitral Awards Can Be Granted On The Basis Of Evidentiary Admissions: Delhi High Court

The Delhi High Court bench of Justice Prateek Jalan has observed that the power to pass an award on admissions is wide, and evidentiary admissions (admissions contained outside pleadings) can also form the basis of an arbitral award. The Court observed that while it is true that admissions in pleadings are placed on a higher footing to the extent that they may require nothing more for a decree to follow, those outside of pleadings must be considered contextually. However, to hold that...

Transfer Pricing | Existence Of International Transaction Must Be Determined Before Benchmarking Analysis Is Commenced: Delhi HC

The Delhi High Court has held that before the Income Tax Department commences transfer pricing benchmarking analysis of an assessee's international transactions, the very existence of such 'international transaction' must be determined.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar, while dealing with the case of an Indian entity producing liquor for brands like Jim Beam, observed, “the commencement of a benchmarking analysis would have to necessarily be preceded by...

Income Tax Department Cannot Attach Properties Indefinitely Without Pursuing Steps To Resolve Matter: Delhi High Court

The Delhi High Court has held that the Income Tax Department cannot, suspecting escapement of tax on income by an assessee, indefinitely attach its properties without taking further steps to resolve the matter.Single judge Justice Sachin Datta observed that Section 222 of the Income Tax Act, 1961 which empowers the Tax Recovery Officer to proceed with “attachment and sale of assessee's movable property” to recover the due taxes, explicitly states “attachment and sale,” signifying a sequential...

Shamshera Movie Copyright Case: Delhi High Court Stays Further Investigation In FIR Against Yash Raj Films, Aditya Chopra

The Delhi High Court has stayed further investigation against Yash Raj Films Private Limited and director Aditya Chopra in the FIR registered against them in relation to the Shamshera movie copyright case.The FIR was registered on May 01, 2024, for the offences under Section 63 (offence of copyright infringement) of Copyright Act and Section 420 (cheating and dishonestly inducing someone to deliver property) of Indian Penal Code. Justice Anup Jairam Bhambhani observed that further investigation...

S.67 Of CGST Act & S.110 Of Customs Act Are Pari Materia; GST Department Must Give Notice To Assessee Before Extending Seizure Period: Delhi HC

The Delhi High Court has held that an assessee must be issued notice within six months of seizure of its goods under Section 67 of the Central Goods and Services Tax Act 2017, failing which the goods must be returned by the Department.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar further held that the period of seizure cannot be extended under Section 67)7) for a further six-month period without giving notice to the accused.This, as the Court found the provision to...

'Highly Undesirable Practice, Wastes Judicial Time': Delhi High Court Laments Frequent Non-Appearance Of Govt Counsel In Customs Matters

The Delhi High Court recently expressed its displeasure at the frequent non-appearance of government counsel in customs related matters.A division bench comprising Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “It is noticed that in a large number of customs matters, the Counsels are either not appearing or appear without proper instructions. In cases of nonappearance, the Court is compelled to request Standing Counsels present in Court to accept notice. This reflects a clear...

'Extra Duty Deposit' Different From Customs Duty, Limitation For Seeking Refund U/S 27 Of Customs Act Is Inapplicable: Delhi High Court

The Delhi High Court has held that an Extra Duty Deposit (EDD) does not constitute a payment in the nature of customs duty under the scope of Section 27 of the Customs Act, 1962 and thus, the period of limitation for seeking a refund of customs duty under the provision would not apply qua EDD.Section 27 deals with a person/entity's claim for a refund of Customs duty in certain circumstances.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma observed, “A perusal of Section 27...

Survey Report On Existence Of 'Permanent Establishment' In Tax Year Not Relevant For Previous/Future AYs: Delhi HC Grants Relief To Swiss Co

The Delhi High Court has held that the existence of a foreign entity's Permanent Establishment (PE) in India is required to be determined in law for each year separately on the basis of the scope, extent, nature and duration of activities in each year.A division bench of Justices Yashwant Varma and Ravinder Dudeja made the observation while dealing with a Swiss company's case, which was aggrieved by various reassessment notices issued for AYs 2013-18 for alleged escapement of income generated by...

CESTAT Can't Reject Appeal Merely Because Pre-Deposit Was Made In Wrong Account, Especially When Rules Were Unclear: Delhi High Court

The Delhi High Court has held that merely because a pre-deposit prescribed under Section 35F of the Central Excise Act, 1944, for preferring an appeal is made in the wrong account, that too when the integrated portal might not have been fully functional, cannot result in rejection of appeal on the ground of defects.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta was dealing with a petitioner preferred by M/s DD Interiors, challenging the return of its appeal by CESTAT,...