Delhi High Court

S.13 Income Tax Act | Charitable Trust's Status Not Affected For Making Reasonable Payments On Services Rendered By Related Party: Delhi HC

The Delhi High Court has held that a Charitable Trust's status cannot be taken away citing violation of Section 13 of the Income Tax Act, 1961 merely because it made reasonable payment for services rendered by a related party.Ordinarily, Charitable Trusts are not allowed to make payments for the benefit of 'prohibited parties'.Section 13 states that exemptions to Charitable Trust under Section 11/12 of the Act would not be available to the extent that the said income is applied for the benefit...

S.107(6) Of CGST Act Does Not Grant Discretion To Court For Waiving Pre-Deposit At Time Of Filing Appeal: Delhi High Court

The Delhi High Court has made it clear that it has no discretion to allow a prayer seeking waiver of pre-deposit condition prescribed under Section 107(6) of the Central Goods and Services Tax Act, 2017 for preferring an appeal under the statute.In terms of Section 107(6), insofar as the admitted tax, interest or penalty is concerned, the entire amount would have to be deposited. In so far as the disputed amount is concerned, 10% of the tax would have to be deposited as a pre-deposit along with...

Grant Of Post-Award Interest U/S 31(7)(B) Of A&C Act Is Mandatory, Arbitrator's Discretion Limited To Rate Of Interest: Delhi HC

The Delhi High Court bench of Justice Ravinder Dudeja has held that the grant of post-award interest under Section 31(7)(b) of the Arbitration and Conciliation Act, 1996 (“the Act”) is mandatory. The only discretion which the Arbitral Tribunal has is to decide the rate of interest to be awarded. Where the Arbitrator does not fix any rate of interest, then statutory rate, as provided in Section 31(7)(b), shall apply. Brief Facts Petitioner No. 1 i.e., Northern Railway, awarded...

Delhi High Court Rejects Income Tax Dept's Appeal Raising ₹42 Crore Demand On NTPC Subsidiary

The Delhi High Court dismissed an appeal preferred by the Income Tax Department raising a demand of ₹42,16,04,786/- from a wholly owned subsidiary of National Thermal Power Corporation Limited (NTPC).The demand was raised in view of alleged income from sale of fly ash, transferred to it by NTPC.As per factual matrix of the case, the fly ash was transferred to the assessee in view of Environment Ministry's notification requiring all thermal plants to utilize the fly ash generated from the power...

Delivering Arbitral Award To Power Of Attorney Holder Satisfies Requirement Of 'Delivery' U/S 31(5) Of A&C Act: Delhi High Court

The Delhi High Court bench of Justices Navin Chawla and Ravinder Dudeja has observed that the delivery of a copy of the Award to the Power of Attorney holder, who has also represented the party in the arbitral proceedings, shall be a due compliance with Section 31(5) of the A&C Act. Facts Disputes arose between the parties in relation to the Collaboration Agreement dated 14.05.2001. A Sole Arbitrator was appointed by this Court vide its order dated 16.10.2005. The impugned...

Delhi High Court Reduces Suspension Period Imposed By IBBI Disciplinary Committee On Insolvency Professional, Finds Penalty Disproportionate

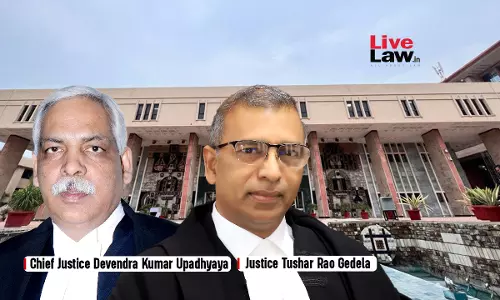

The Delhi High Court bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela have reduced the suspension period imposed on the Appellant/Resolution Professional, noting that the Disciplinary Committee of IBBI overlooked material aspects and relied on incorrect data while imposing the penalty. It reduced the suspension to the period already undergone. Brief Facts The NCLT admitted an application under Section 9 of the IBC against GTHS Retails Pvt. Ltd. on...

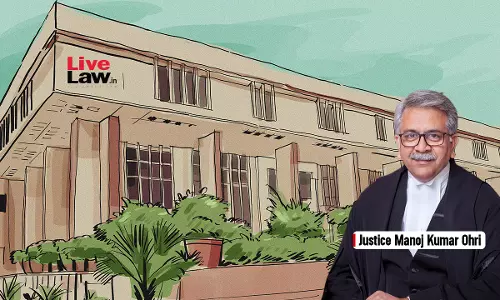

Writ Petition Cannot Be Construed As “Earlier Application” U/S 42 Of Arbitration & Conciliation Act: Delhi High Court

The Delhi High Court Bench of Justice Manoj Kumar Ohri has observed that a writ petition cannot be construed as an "earlier application" under Section 42 of the Arbitration Act to decide jurisdiction as the very nature of a writ petition is to challenge an administrative action or a legal decision, not to initiate arbitration proceedings.Section 42 specifically refers to an "application made in a Court with respect to an arbitration agreement," which implies an initial application to...

S.54(11) GST Act | Assessee's Refund Can't Be Held Back On Commissioner's Opinion Alone, Twin Conditions Must Be Satisfied: Delhi HC

The Delhi High Court has held that Section 54(11) of the Central Goods and Services Tax Act, 2017 prescribes twin conditions for Revenue holding back Refund due to an Assesseee, despite an order to that effect.Section 54(11) of the Act would show that the refund can be held back on the satisfaction of the following two conditions – (i) when an order directing a refund is subject matter of a proceeding which is pending either in appeal or any other proceeding under the Act; and (ii) thereafter...

S.161 DGST Act | Personal Hearing Can Be Dispensed Only If Assessee's Rectification Application Is Allowed, Not Rejected: Delhi HC

The Delhi High Court has held that in terms of proviso 3 to Section 161 of the Delhi Goods and Service Tax Act, 2017, an order rejecting the rectification application filed by an assessee cannot be passed without first hearing the assessee.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta further said that the hearing can be dispensed with only where the rectification application is allowed. It observed,“As per proviso 3 to Section 161, the rectification order, if allowed...

Delhi HC Flags Rise In GST Litigation, Asks Department To Depute Officials To Enable Expeditious Disposal

The Delhi High Court has flagged the rise in number of GST related cases being filed before it and to ensure expeditious disposal of cases, particularly those arising out of procedural issues, has asked the Department to depute at least two officials from its litigation section.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta said these officials can coordinate with the various Commissionerates of the GST department and give instructions to the Department's counsels, in an...

Delhi VAT | No Interest On Refund For Period Of Delay Attributable To Dealer: High Court

The Delhi High Court has held that if the delay in granting refund to a dealer under the Delhi Value Added Tax Act, 2004 is attributable to the dealer itself, such period of delay shall be excluded for the purposes of awarding interest on refund.Section 38(3)(a)(ii) of DVAT Act stipulates a period of two months for refund of excess tax, penalty, etc., if the period for refund is a quarter.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta cited Explanation to Section 42(1)...

[Arbitration] Referral Court Should Limit Enquiry To Whether Plea Has Been Filed Within Limitation, Not Whether Claims Are Ex-Facie Time Barred: Delhi HC

The Delhi High Court bench of Justice Manoj Kumar Ohri has observed that at the stage of appointment of arbitrator under Section 11, A&C, the referral court should limit its inquiry to whether the petition itself is within the limitation period of three years and should leave the question of whether the claims are deadwood to the arbitral tribunal. Facts The Petitioner firm purchased certain quantity of scrap auctioned by Northern Railway (“the Department”) on 16.05.2001 for...