Delhi High Court

Valuation Of Company's Unquoted Equity Shares By 'Discounted Cash Flow' Method Permissible Under Income Tax Rules: Delhi High Court

The Delhi High Court recently rejected the appeal preferred by the Income Tax Department against an ITAT order allowing the valuation of a software company's unquoted equity shares by discounted cash flow [DCF] method.In doing so, a division bench of Justices Vibhu Bakhru and Tejas Karia held that DCF method “is one of the methods that can be adopted by the Assessee under Rule 11UA(2)(b) of the [Income Tax] Rules for determining the FMV of unquoted equity shares in a company in which public are...

Jurisdiction Of Arbitral Tribunal Continues Despite Provisional Attachment Of Assets Under PMLA Or Parallel Proceedings: Delhi High Court

The Delhi High Court bench of Justice Amit Mahajan has held that the mere reference to certain assets in a provisional attachment order does not, by itself, oust the jurisdiction of the arbitral tribunal. Similarly, the pendency of parallel investigations by the CBI or ED into allegations of fraud does not bar the arbitrator from adjudicating the dispute. Arbitration proceedings can continue independently, even when some aspects of the subject matter are under criminal investigation. ...

'File Movement' & 'Change In Counsel' Not Sufficient Cause For Condonation Of Delay In Filing S.37 Arbitral Appeals: Delhi High Court

The Delhi High Court bench comprising Justice Prathiba M. Singh and Justice Rajneesh Kumar Gupta has held that mere movement of file and change in counsel due to administrative issues does not constitute “sufficient cause” to condone inordinate delay in filing an appeal under Section 37 of the Arbitration and Conciliation Act, 1996.The court reiterated that for appeals under Section 37 that are governed by Articles 116 and 117 of the Limitation Act or Section 13(1-A) of the Commercial Courts...

GST | Separate Demands For Reversal Of Availed ITC & Utilisation Of ITC Is Prima Facie Duplication Of Demand: Delhi High Court

The Delhi High Court has observed that demand raised against an assessee qua reversal of availed Input Tax Credit (ITC) and qua utilisation of ITC prima facie constitutes double demand.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted liberty to the Petitioner-assessee to approach the Appellate Authority against such demand, and waived predeposit qua demand of ineligible ITC.It observed, “On a prima facie view, it appears that there would be duplication of two...

Arbitration Clause Allowing MD To Appoint Sole Arbitrator After Failure Of Appointment By Mutual Consent Violates SC's Order: Delhi High Court

The Delhi High Court bench of Justice Jyoti Singh has held that the clause in question indeed contemplates the appointment of an Arbitrator by mutual consent; however, in the event of failure, it vests the power of appointing a Sole Arbitrator with the Managing Director of Respondent No. 1. It further held that the Company acting through its Managing Director will have interest in the outcome of the dispute and therefore, appointment of Sole Arbitrator will be directly hit by the law...

Recourse To External Correspondences To Interpret Clause Despite Clear & Unambiguous Terms Amounts To 'Patent Illegality': Delhi High Court

The Delhi High Court bench comprising Justice Vibhu Bakhru and Justice Tejas Karia has held that when the language of the contract is plain, clear and unambiguous, recourse to internal aids of interpretation or extraneous materials such as negotiations and correspondence is impermissible. “Ignoring an explicit clause of the contract or acting contrary to the terms of the contract amounts to patent illegality.”, the court held. Brief Facts The Appellant entered into contracts with ...

Once Right To File Written Statement Is Closed, Application U/S 8 Of Arbitration Act Can't Be Entertained: Delhi High Court

The Delhi High Court bench of Justices Shalinder Kaur and Navin Chawla has held that once the right to file a written statement is closed, an application under Section 8 of the Arbitration and Conciliation Act seeking reference to arbitration is not maintainable. Brief Facts: This Regular First Appeal under Section 13 of the Commercial Courts Act, 2015 challenges the judgment dated 25.11.2024 passed by the District Judge, Commercial Court-06, South-East District, Saket Courts, New...

Applicability Of Arbitration Clause Is To Be Determined By Arbitrator, Cannot Be Decided In S.11 Plea: Delhi High Court

The Delhi High Court Bench of Justice Sachin Datta has held that contentions regarding the applicability and relevance of an arbitration agreement are to be dealt with by the arbitrator and cannot be gone into at the stage of section 11 petition. Once the existence of arbitration agreement is not disputed, any dispute related to the applicability of the agreement has to be dealt by the arbitrator. Brief Facts of the case: The petition under Section 11 of the Arbitration and...

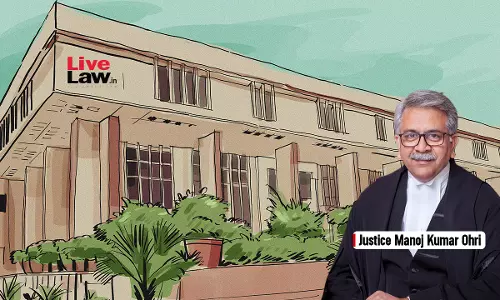

Inconsequential Errors Cannot Be Grounds To Challenge Judicious & Reasoned Award U/S 34 Of Arbitration Act: Delhi High Court

The Delhi High Court Bench of Justice Manoj Kunar Ohri has held that the petitioner cannot take advantage of apparent inconsequential errors and fumbles to challenge the award. Inconsequential errors in the award cannot be a ground to challenge otherwise judicious and reasoned award. Brief Facts of the case: The respondent accepted an offer letter to procure a machine from the petitioner. As per the terms, the petitioner was obligated to deliver the machine within a period of ten...

Dispute Review Board's Recommendations Are Arbitral Awards, Enforceable U/S 36 Of A&C Act: Delhi High Court

The Delhi High Court bench of Justice Vibhu Bakhru and Justice Tejas Karia has held that the recommendations of the Dispute Review Board (DRB) rendered under a contract constitute an arbitral award which is enforceable as a decree under Section 36 of the Arbitration and Conciliation Act, 1996. The court further held that the limitation for enforcement begins from the date of the award, not from the date of the judgment declaring it as an 'award'. Brief Facts: The appellant,...

[Income Tax] Delhi HC Larger Bench To Decide On Retrospective Applicability Of Extended Limitation For Reassessment In Cases Involving Foreign Assets

A larger bench of the Delhi High Court will decide whether Section 149(1)(c) of the Income Tax Act 1961, inserted vide a 2012 amendment to provide an extended period of reassessment for cases involving foreign assets, applies retrospectively.Section 149(1)(c) prescribes that reassessment notice in respect of any income in relation to any asset located outside India, which had escaped assessment, is not proscribed for a period of 16 years from the end of the assessment year in which such income...

S.161 CGST Act | Rectification Order Must Be Reasoned, Adverse Order Can Be Passed Only After Hearing Party: Delhi High Court

The Delhi High Court has made it clear that an order in rectification proceedings must be reasoned, passed after affording an opportunity of hearing to the party.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta made the observation while dealing with a petition against rejection of Petitioner's application seeking rectification of impugned demand orderPetitioner pointed out that in terms of the proviso 3 to Section 161 of the Central/Delhi Goods and Services Tax Act, 2017...