Delhi High Court

Delhi High Court Directs 'American Dream11' To Take Down Social Media Pages Infringing Dream11's Mark

The Delhi High Court has directed American Dream 11, a US-based fantasy gaming company, to take down or block all its social media pages and profiles that allegedly infringe the trademark Dream11 on platforms such as Facebook, X (formerly Twitter), LinkedIn, and Instagram.A single-judge bench of Justice Tejas Karia passed the order while hearing a plea filed by Sporta Technologies Pvt. Ltd., which operates India's leading fantasy sports platform Dream11. It observed: “It is directed...

GST Department Must Decide Refund Applications Expeditiously, Any Delay Adversely Affects Business: Delhi High Court

The Delhi High Court has called upon the Goods and Services Tax Department to expeditiously process the refund applications filed by registered persons/ entities.A division bench of Justices Prathiba M. Singh and Shail Jain observed, “As per the statutorily prescribed procedure, the refund applications have to be dealt with in a particular manner within the prescribed timelines as per law…if there is delay by the Department in processing and granting refunds, it has a cascading adverse effect on...

Delhi High Court Raps Income Tax Dept For Over Two-Year Delay In Implementing ITAT Order; Directs Refund With Interest Within One Month

The Delhi High Court recently criticized the Income Tax Department for an over 2-year delay in implementing an ITAT order, directing it to reconsider the demand raised against an assessee.A division bench of Justices Prathiba M. Singh and aShail Jain observed that the Income Tax Department must implement judicial orders with “alacrity” however in this case, it woke up only after the assessee moved the High Court to seek enforcement of the ITAT order passed back in January 2023.“The Court notes...

Informer Of GST Evasion Cannot Seek Reward As A Matter Of Right: Delhi High Court

The Delhi High Court has prima facie observed that an informer, who apprises the Department about evasion of goods and services tax by an entity, cannot seek reward for sharing such information as a matter of right.A division bench of Justices Prathiba M. Singh and Shail Jain were of the prima facie view that no such right vests in any informer.“In the opinion of this Court, the grant of an award or a reward to an informer is a discretionary grant,” it said.The development comes in a petition...

GST Dept Can't Raise Fresh Demand U/S 73 If Explanation Offered By Assessee U/S 61(2) Was Accepted: Delhi High Court

The Delhi High Court has made it clear that Section 61(2) of the Goods and Service Tax Act, 2017 bars further action against an assessee, including any demand under Section 73.For context, Section 61 empowers the proper officer to scrutinize the return furnished by the registered person and inform him of the discrepancies noticed.Sub-section (2) thereof provides that in case the explanation offered by the registered person is found to be acceptable, no further action shall be taken.A division...

Delhi High Court Refuses To Stay Order Restraining Ravi Mohan Studios From Using 'BRO CODE' For Tamil Film

The Delhi High Court on Wednesday refused to stay the operation of a single-judge order that had restrained actor Ravi Mohan's production house from using the title 'BRO CODE' for its upcoming Tamil film, following a trademark dispute with Indospirit Beverages Private Limited, the maker of the alcoholic beverage 'BROCODE'.A division bench comprising Justice C Hari Shankar and Justice Om Prakash Shukla issued notice on the appeal filed by Ravi Mohan Studios but declined to grant an interim stay,...

Delhi High Court Sets Aside Reassessment Order Against Vedanta; Orders Fresh Consideration After GST Case Over Alleged ₹424-Crore ITC Fraud Closed

In granting relief to Vedanta Limited, the Delhi High Court has set aside an order of the the Income Tax Department for initiation of reassessment action against the Copper manufacturer, over alleged fraudulent availment of Input tax credit worth over ₹424 Crore.A division bench of Justices Prathiba M. Singh and Shail Jain observed that the GST Department had already closed the case.“Closing of the proceedings by the GST Department would have an impact and bearing on the Section 148A proceedings...

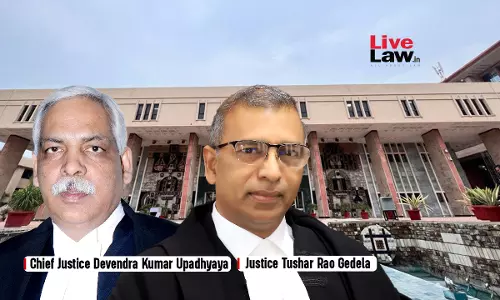

Typographical Error In Title Of Arbitral Award Can Be Corrected Beyond 30 Days If Caused By Tribunal's Mistake: Delhi High Court

The Delhi High Court held that a clerical or typographical error in the title of an arbitral award can be corrected even after 30 day limitation period provided under section 33 of the Arbitration Act if the mistake originated from the tribunal itself and not from the parties. The Division Bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela dismissed an appeal filed by the Institute of Human Behaviour and Allied Sciences (IHBAS), which had challenged a...

Conduct Inter-Ministerial Consultation On Whether Import Of Massagers/Sex Toys Is Allowed Or Not: Delhi High Court Tells CBIC

The Delhi High Court has directed the CBIC (Central Board of Indirect Taxes and Customs) to conduct inter-ministerial consultation in respect of coming up with a uniform policy permitting or prohibiting the import of products declared as 'body massagers' or sex toys. The bench opined that the question as to whether any product is obscene or not cannot, obviously, be left at the discretion of the Commissioner of Customs and other individual officials in the absence of uniform guidelines...

Paytm Moves NCLT Delhi Against WinZO Games Over ₹3.6 Crore Unpaid Advertising Dues

The National Company Law Tribunal (NCLT) at Delhi on Tuesday issued notice to WinZO Games after Paytm (One97 Communications Ltd) filed an insolvency plea claiming that the gaming company failed to pay around Rs 3.6 crore for advertising services. Judicial Member Justice Jyotsna Sharma and Technical Member Anu Jagmohan Singh heard the matter briefly and gave WinZO two weeks to file its reply. The matter is listed again on December 15.According to Paytm, the unpaid amount relates to four invoices...

Advance Given For Profit-Sharing In Real Estate Project Cannot Be Treated As 'Financial Debt': NCLAT New Delhi

The National Company Law Appellate Tribunal (NCLAT) New Delhi upheld the decision passed by the National Company Law Tribunal (NCLT) by which it had rejected an application under section 7 of the Insolvency and Bankruptcy Code, 2016 (IBC) filed by M/s Meck Pharmaceuticals and Chemicals Pvt. Ltd. against M/s Accurate Infrabuild Pvt. Ltd. A Bench comprising Justice Ashok Bhushan (Chairperson) and Mr. Barun Mitra (Technical Member) observed that the advance payment made for the...

Delhi High Court Restrains Patanjali from Broadcasting 'Dhoka' Chyawanprash Ad in Dabur's Plea

The Delhi High Court has barred Patanjali Ayurved from airing an advertisement that labeled all other Chyawanprash products as “dhoka” (deception), ruling that it constitutes commercial disparagement. The restriction will remain in place until the next hearing on February 26, 2026. The court also directed Patanjali to remove, block, or disable the advertisement across all platforms within 72 hours of receiving the order. This includes national television channels, streaming platforms, digital...