Bombay High Court

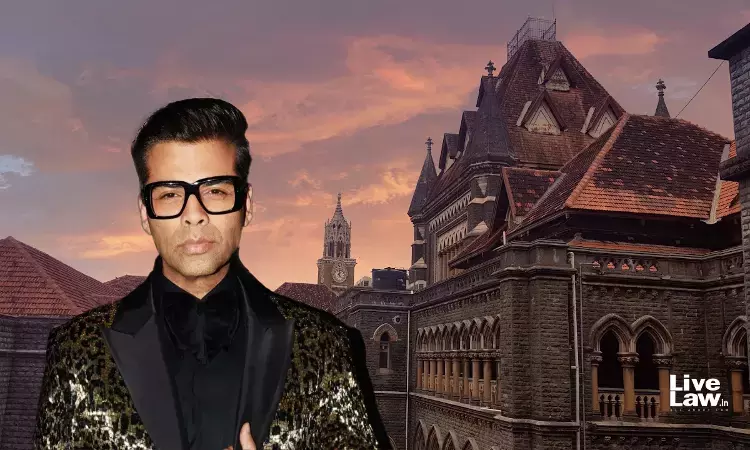

Relief For Karan Johar As Bombay High Court Refuses To Permit Release Of 'Shaadi Ke Director Karan Aur Johar' Film

In a big win for film-maker and producer Karan Johar, the Bombay High Court on Friday refused to lift the stay on the release of a film "Shaadi Ke Director Karan Aur Johar" which was imposed in June last year.Single-judge Justice Riyaz Chagla said that the makers of the film 'unauthorisedly' by using Johar's name and personality attributes in the title of their film, prima facie, violated his personality rights, publicity rights and also his right to privacy. "Further, the Plaintiff (Johar)...

LLP Can Be Bound By Arbitration Clause Despite Not Being Signatory To LLP Agreement: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the mere fact that an LLP is not a signatory to an LLP Agreement does not, by itself, preclude it from being a party to arbitration proceedings initiated between Partners under the arbitration clause of such an agreement. The Court observed that an LLP is not a “third party” to its LLP Agreement but an entity with rights and obligations vis-à-vis its partners as per the statutory scheme of the LLP Act. The Arbitral...

Restaurant Service Or Bakery Product? Bombay High Court To Decide If Donuts & Cakes Should Be Taxed At 5% Or 18% Under GST

The Bombay High Court is to decide whether the donuts and cakes should be classified as restaurant service or a bakery product under Goods and Services Tax. The Division Bench of Justices B.P Colabawalla and Firdosh P. Pooniwalla were addressing the issue of whether the supply of donuts falls within the ambit of restaurant services under Service Accounting Code (SAC) 9963 or should be categorized as a bakery product subject to separate tax treatment under the Goods and Services Tax...

ITAT Cannot Perpetuate Ex-Parte Order: Bombay High Court Orders Tribunal To Grant Opportunity Of Hearing To Assessee Before Proceeding On Merits

The Bombay High Court has disapproved of the Income Tax Appellate Tribunal dismissing the appeal against an ex-parte order passed against a former employee of Pfizer Healthcare without providing him an opportunity of hearing.Stating that ITAT cannot “perpetuate” the ex-parte order, a division bench of Justices GS Kulkarni and Advait M. Sethna directed the Tribunal to hear the employee de novo, so far as his prayer for the grant of exemption under section 89 of the Income Tax Act, 1961 is...

ITAT Cannot Overstep Its Authority By Deciding On Merits When It Had Already Concluded Appeal Was Not Maintainable: Bombay High Court

The Bombay High Court stated that ITAT cannot overstep its authority by deciding on merits when it has already concluded an appeal was not maintainable. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “Once the ITAT concluded that the Appeal before it against the impugned communication/order was not “maintainable”, there was no question of the ITAT evaluating the impugned communication/order on its merits or making any observations or recording any findings...

Court At Designated Venue In Arbitration Agreement Can Entertain Application U/S 11 Of Arbitration Act: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the court having supervisory over designated venue of the Arbitration proceedings would have jurisdiction to entertain application under section 11 of the Arbitration and Conciliation Act, 1996 (“Arbitration Act”) in absence of any contrary indicia indicating any other place to be the seat of arbitration. Brief Facts: The present application under section 9 of the Arbitration Act has been filed seeking...

Limitation For Appeal U/S 37 Of Arbitration Act Is Governed By Article 116 Of Limitation Act, Delay Not To Be Condoned In Mechanical Manner: Bombay HC

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the delay in filing an appeal under section 37 of the Arbitration and Conciliation Act,1996 (“Arbitration Act”) should not be condoned in a mechanical manner as it would defeat the very objective of the Arbitration Act which is to provide a speedy resolution of disputes. It also held that as per judgment of the Supreme Court in Executive Engineer v. Borse Brothers Engineers and Contractors Private Limited (2021),...

When There Is Ambiguity In Arbitration Agreement, Business Efficacy Test Can Applied To Discern Intent Of Parties To Arbitrate: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that when there is an ambiguity in the agreement with respect to arbitration related provisions, the business efficacy test can be applied to discern true intent of the parties to arbitrate. Brief Facts: The present petition has been filed under section 11 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) seeking appointment of an Arbitrator. A Hotel Franchisee and Management Agreement (“Resort...

Mandate Of Facilitation Council Is Not Terminated Even If It Fails To Render Award Within 90 Days U/S 18(5) Of MSME Act: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the mandate of the MSME Facilitation Council (Council) cannot be terminated merely on the ground that it failed to render an award within 90 days under section 18(5) of the Micro, Small and Medium Enterprises Development Act, 2006 (“MSME Act”) from the date of entering reference as this time period is directory in nature. Brief Facts: In this Petition under Section 34 of the Arbitration and Conciliation Act,...

Notice Issued To Non-Existing Entity Post-Merger Is Substantive Illegality, Dept Cannot Cite Technical Glitch: Bombay High Court

The Bombay High Court stated that notice issued to a non-existing entity post-merger is a substantive illegality and not some procedural violation. “we cannot condone the fundamental error in issuing the impugned notices against a non-existing company despite full knowledge of the merger. The impugned notices, which are non-est cannot be treated as “good” as urged on behalf of the department” stated the Division Bench of Justices M.S. Sonak and Jitendra Jain. In this case, the...

Bombay HC 'Disappointed' With CBI & Mumbai Police Showing Reluctance To Probe Multi-Crore Money Laundering Case; Orders Formation Of SIT

The Bombay High Court recently expressed 'disappointment' over the Central Bureau of Investigation (CBI) and also the Economic Offences Wing (EOW) of the Mumbai Police, both showing 'reluctance' to investigate into the complaints of multi-crore fraud by a company both in India and also several foraging countries.A division bench of Justices Revati Mohite-Dere and Prithviraj Chavan noted that both the EOW as well as the CBI, for the reasons best known to these Agencies, were reluctant to...