Bombay High Court

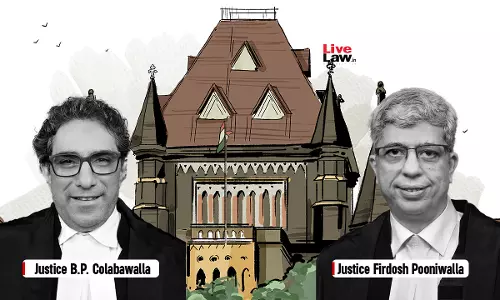

Income Tax | Interest On Fixed Deposits, TDS Refund Linked To Business Qualifies For S. 80IA Deduction: Bombay High Court

The Bombay High Court held that interest on fixed deposits, TDS refund linked to business qualifies for deduction under Section 80IA of the Income Tax Act. Section 80IA of the Income Tax Act, 1961 provides tax incentives for businesses operating in certain sectors such as infrastructure, power, and telecommunications. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that the placement of fixed deposits was imperative for the purpose of carrying on the eligible business of...

Three-Month Deadline For Passing Arbitral Award Under NSE Byelaws Is Directory And Not Mandatory: Bombay High Court

The Bombay High Court Bench of Justice Somasekhar Sundaresan while deciding a petition under Section 34, Arbitration and Conciliation Act, 1996 (“ACA”) had an occasion to interpret Rule 13, National Stock Exchange (“NSE”) Byelaws. The Court held that Rule 13(b) which provided that arbitral award under the Rules must be rendered within three months from the date of entering upon reference was directory and not mandatory in nature. Facts The present petition was filed under Section...

[GST] Reverse Charge Mechanism Notifications Denying ITC To Service Providers Are Constitutionally Valid: Bombay High Court

The Bombay High Court held that RCM notifications denying ITC credit to service providers are constitutionally valid and does not violate Article 14 and 19(1)(g) of the Constitution. The bench opined that in case of RCM, the person receiving the services, i.e. the recipient pays the tax and can claim credit of the same. The provider of service is exempt from paying tax. Merely because persons covered by RCM cannot claim credit of ITC cannot be seen in a microscopic way to hold the ...

Income Tax | Sale Proceeds Of Vintage Cars Taxable Unless Assessee Proves That Car Was Used As Personal Asset: Bombay High Court

The Bombay High Court held that sale proceeds of vintage car taxable unless the assessee proves that the car was used as a personal asset. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that the capability of a car for personal use would not ipso facto lead to automatic presumption that every car would be personal effects for being excluded from capital assets of the Assessee. In this case, the Assessee had purchased a vintage car for a consideration of Rs.20,000/-....

Bank Guarantee Which Expired Almost Ten Years Before CIRP Was Initiated, Cannot Be Enforced: Bombay High Court

The Bombay High Court stated that expired bank guarantee can't be enforced post CIRP (corporate insolvency resolution process). Justices M.S. Sonak and Jitendra Jain stated that, “The argument that a personal guarantee survives the CIRP does not apply in the case because the guarantee had expired even before the CIRP. During the validity period of the guarantee, admittedly, no claim was lodged by the department. This petition was instituted almost 10 years after the guarantee expired,...

No Sales Tax On HDPE Bags Used To Pack Cement When Sold Separately: Bombay High Court

The Bombay High Court stated that no sales tax can be levied on HDPE (High-Density Polyethylene) bags at cement rate when sold separately. Justices M.S. Sonak and Jitendra Jain were addressing the issue of whether there is an express and independent contract on the sale of HDPE bags in which cement is packed. “HDPE bags used to pack the cement were a distinct commodity with its own identity and were classified separately. There was no chemical or physical change in the packing...

Serving Order On Chartered Accountant Doesn't Count As Service On Assessee: Bombay High Court

The Bombay High Court held that serving order on chartered accountant doesn't count as service on assessee. The issue before the bench was whether the copy of the order passed by the Tribunal when served upon the Chartered Accountant is sufficient service and whether it can be construed as 'copy received by the assesse/applicant'. Justices Bharati Dangre and Nivedita P. Mehta stated that the Chartered Accountant since is not also authorised specifically to accept copy of the order,...

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or by issue of a cheque or draft”. Similarly, in Section 194LA, the words “or by any other mode” would have to...

Income Tax | Sale Proceeds Of One House Used For Purchasing Multiple Residential Houses Qualifies For Exemption U/S 54(1): Bombay High Court

The Bombay High Court held that sale proceeds of one residential house, used for purchase of multiple residential houses, would qualify for exemption under Section 54(1) of the Income Tax Act. The issue before the bench was whether Section 54(1) of the Income Tax Act allows the Assessee to set off the purchase cost of more than one residential units against the capital gains earned from sale of a single residential house. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated...

Proceedings Can Be Remitted Back To Same Arbitrator U/S 33 & 34(4) Of A&C Act Only Before Passing Of Award: Bombay High Court

The Bombay High Court Division Bench, comprising Chief Justice Alok Aradhe and Justice Sandeep V. Marne, observed that a Section 34 Court can only remit back to the same Arbitration following the procedure for remand u/s 33 and 34(4). The act of the Appellant not issuing a notice u/s 21 of the A&C Act to the Respondent, and approaching the same Arbitration, who initiates Arbitral proceedings, results in the Arbitral Tribunal being devoid of jurisdiction. Factual Matrix: The...

Bombay High Court Directs GST Council To Develop Mechanism For Cross-State ITC Transfer In Mergers/Amalgamations

The Bombay High Court has directed the GST Council and GST Network to develop a mechanism for cross-state ITC transfer in Mergers/amalgamations. Justices Bharati Dangre and Nivedita P. Mehta permitted the IGST and CGST amount lying in the electronic credit ledger of the Transferor Company to be transferred to the Petitioner Company by physical mode for the time being, subject to the adjustments to be made in future. The petitioner/Umicore Autocat India Private Limited has raised a...

Member Of Society Can Be Directed To Vacate Premises U/S 9 Of Arbitration Act For Smooth Redevelopment: Bombay High Court

The Bombay High Court bench of Chief Justice Alok Aradhe and Justice Sandeep V. Marne held that a member of a society can be directed to vacate the premises occupied by them under Section 9 of the Arbitration Act to ensure smooth redevelopment, if they act contrary to the terms of the Development Agreement These Appeals have been filed under Section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) challenging the order dated 20 June 2025 passed by the learned Single...

![[GST] Reverse Charge Mechanism Notifications Denying ITC To Service Providers Are Constitutionally Valid: Bombay High Court [GST] Reverse Charge Mechanism Notifications Denying ITC To Service Providers Are Constitutionally Valid: Bombay High Court](https://www.livelaw.in/h-upload/2025/06/12/500x300_604433-justices-ms-sonak-jitendra-jain-bombay-high-court.webp)