Bombay High Court

Bombay High Court Directs WhiteHat Jr To Secure Rs 80.35 Lakh Arbitral Award In Favor Of Former Employee

The Bombay High Court has recently ordered WhiteHat Education Technology Pvt. Ltd. (popularly known as WhiteHat Jr), a subsidiary of embattled ed-tech Byju's, to secure an arbitration award of Rs 80.35 lakh in favour of its former employee, Prashant Singh.The award was granted in an employment dispute following Singh's sudden termination from the company. The Court also directed the company's directors, Byju Raveendran and Riju Raveendran, to comply with the order.A Single bench of Justice...

SARFAESI Act | Lending Banks Only Obligated To Consider Revival Scheme For NPA MSMEs If Borrower Claims Relief U/S 13(3A): Bombay High Court

The Bombay High Court bench, comprising Justice Suman Shyam and Justice Manjusha Deshpande, has held that the lending bank is obligated to consider the MSME revival scheme for classification of account as NPA only if it has been claimed by the MSME in response to the demand notice under Section 13(3A) of the SARFAESI Act. The petitioner's MSME unit took certain loans from ICICI Bank and the Technology Development Board (TBD). The ICICI Bank classified its account as NPA on February...

'Higher Credence Is Given To Award Passed After Detailed Pre-Arbitral Process': Bombay High Court

The Bombay High Court has held that arbitral awards passed after a detailed pre-arbitral process contractually agreed upon by the parties deserve a higher degree of credibility and judicial deference. The Court refused to grant an unconditional stay on the execution of an arbitral award in favour of the contractor, holding that mere disagreement with the arbitral tribunal's findings does not establish perversity warranting such relief.Justice Somasekhar Sundaresan was hearing an application...

'Unrelated Party To Contract Cannot Be Regarded As Veritable Party To Arbitration Agreement': Bombay High Court

The Bombay High Court has held that an unrelated third party to a contract cannot be treated as a “veritable party” to the arbitration agreement and hence cannot be compelled to participate in the arbitral proceedings. The Court reiterated that the doctrine enabling non-signatories to be treated as parties to an arbitration agreement applies only where there exists a close relationship, such as within a group of companies, or where there is an alter ego or composite transaction linking the...

'Big Corporations Must Adopt Reasonable Litigation Policy Against Small Enterprises': Bombay High Court

The Bombay High Court dismissed an appeal under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) filed by Mahindra Defence Systems Ltd. challenging an arbitral award passed by the Micro, Small and Medium Enterprises Facilitation Council in favour of Rajana Industries holding that the award was reasoned, fair and free from perversity. Justice Somasekhar Sundaresan while upholding concurrent findings of the District Judge and the Council observed that industry...

Information Regarding GST Returns Of Company Cannot Be Disclosed Under RTI Act: Bombay High Court

The Bombay High Court on Tuesday (October 14) held that a company's Goods and Services Tax (GST) returns filing cannot be disclosed under the Right To Information (RTI) Act. Sitting at Aurangabad bench, single-judge Justice Arun Pednekar noted that section 158(1) of the GST Act prohibits disclosure of information of GST returns to third parties and that section 8(1)(j) of the RTI Act too exempts certain information from being made public unless the information officer is satisfied that the...

Pendency Of Appeal U/S 37 A&C Act Against First Award Does Not Bar Fresh Arbitration Proceedings: Bombay High Court

The Bombay High Court held that pendency of an appeal under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) does not prohibit a party from initiating a fresh round of arbitration when an earlier arbitral award has already been set aside. Accordingly, the present application under section 11 of the Arbitration Act was allowed and a sole arbitrator was appointed. Justice Gautam A. Ankhad held that “the Section 11 Court ought not to venture beyond examining the ...

Apportionment Of Liability Without Evidence Is Akin To 'Panchayati Approach': Bombay High Court Sets Aside NSE Arbitral Award Against Broker

The Bombay High Court set aside an arbitral award passed under National Stock Exchange (NSE) bye-laws that had upheld an order passed by Investor Grievance Redressal Panel (IGRP) directing Peerless Securities Limited to pay ₹7.18 lakhs to Vostok (Fareast) Securities Pvt. Ltd. for the losses caused by unauthorised trading in the trading and future segment. The IGRP had held that both the parties were equally responsible for the losses and directed the broker to bear 50% of the liability....

Mortgage, Enforcement And Related Declaratory Reliefs Are Non-Arbitrable: Bombay High Court

The Bombay High Court Bench of Justice Sandeep V Marne has observed that enforcement of mortgage is a right in rem and any dispute seeking enforcement of mortgage cannot be referred to arbitration. Civil suit will lie for enforcement of such a right in rem. Facts Defendant No.1 and his partners are developers appointed for redevelopment of Defendant No.5 – Society under Development Agreement dated February, 2014 and Supplemental Development Agreement dated March 16, 2021. The...

Income Tax Act | Deputy Commissioner Cannot Act Beyond DRP Directions; Assessment After S.144C(13) Time Limit Invalid: Bombay High Court

The Bombay High Court stated that the Deputy Commissioner cannot act beyond the dispute resolution panel (DRP) directions; assessment completed beyond Section 144C(13) of the Income Tax Act, 1961, the time limit is invalid. Section 144C(13) of the Income Tax Act, 1961 mandates the completion of the assessment within one month from the end of the month in which DRP directions are received. Justices B.P. Colabawalla and Amit S. Jamsandekar stated that the Deputy Commissioner cannot...

Input Tax Credit Can't Be Blocked If Credit Balance Is Nil: Bombay High Court

The Bombay High Court on Tuesday held that Input Tax Credit (ITC) cannot be blocked under Rule 86-A of the Central Goods and Services Tax Rules, 2017, if the electronic credit ledger of a taxpayer shows a nil balance on the date of the blocking order. A Division Bench of Justice M S Sonak and Justice Advait M Sethna observed, “Therefore, on a plain reading of the rule, if on the date of issuing the impugned order or on the date of making an order under Rule 86-A blocking the ITC in...

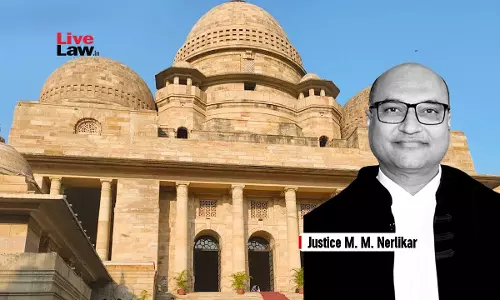

Prior IBC Proceedings Don't Bar Criminal Prosecution Of Directors Under S. 138 Negotiable Instruments Act: Bombay High Court

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act. Background of the Case The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as a security by the director. The NCLT admitted the respondent company into the CIRP, and its failure ...