Bombay High Court

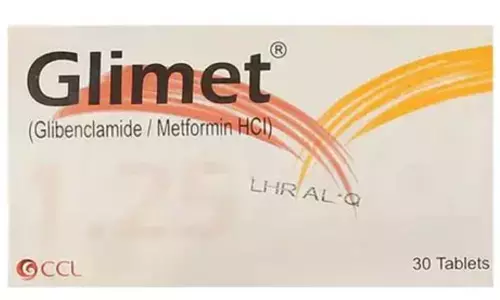

Bombay High Court Blocks Sale Of Diabetes Drug ELGIMET For Similarity To GLIMET's Mark

The Bombay High Court on Tuesday restrained the use of the diabetes drug mark ELGIMET, finding it deceptively similar to the registered mark GLIMET, and confirmed an interim injunction against its sale and manufacture. A single bench of Justice Sharmila U Deshmukh, observed that “GLIMET” and “ELGIMET” were phonetically and structurally similar and that an average consumer with imperfect recollection could easily confuse the two. The dispute arose when Laboratories Griffon Pvt. Ltd., maker...

Rebate Under Rule 18 CER Cannot Be Denied Without Examining Duty On Exported Goods: Bombay High Court Remands Yamaha's Claim

The Bombay High Court has held that a rebate under Rule 18 Central Excise Rules, 2002, cannot be denied without determining the tax liability on exported goods, and has remanded Yamaha's rebate claim to the principal commissioner for fresh consideration. Justices M.S. Sonak and Advait M. Sethna were examining whether the India Yamaha Motor P. Limited was entitled to a rebate under Rule 18 CER 2002 read with Notification No. 19/2004-CE(NT) dated 6 September 2024 in respect of the...

IT Act | 'Charitable Trust's Bona Fide Mistake Due To Misprint In Taxmann Bare Act': Bombay High Court Condones Delay In Filing Form 9A

The Bombay High Court allowed a writ petition filed by the Charitable Trust “Savitribai Phule Shikshan Prasarak” seeking quashing and setting aside of the Order passed by the Directorate General of Income Tax Investigation (Investigation) Pune whereby the Trust/Petitioner's application for condonation of delay 509 days in filing its Form 9A for the Assessment Year 2022-23 was rejected.Per Explanation below Section 11(7) of the Income Tax Act, 196, the Charitable Trusts were required to claim...

Suspension Of Proceedings By Arbitrator For Non-Payment Of Revised Fees Amounts To Effective Withdrawal From Office: Bombay High Court

The Bombay High Court held that an arbitrator who suspended the proceedings indefinitely on the ground of non-payment of revised fees and thereafter failed to conduct hearings must be deemed to have withdrawn from office under section 15 of the Arbitration and Conciliation Act, 1996 (Arbitration Act). The court further held that the arbitrator's mandate had also expired by efflux of time under section 29A of the Arbitration Act thereby necessitating the appointment of a substitute ...

S.74 Finance Act Cannot Be Invoked To Seek Redetermination Of Service Tax Liability: Bombay High Court

On November 14th, 2025, the High Court of Bombay at Aurangabad dismissed a writ petition filed by M/s Suman Construction (“assessee” hereinafter), a government-registered civil contractor, which had challenged the service tax demand raised on road construction works for government departments. The principal issue before the Court was whether the assessee could invoke a rectification application under Section 74 of the Finance Act to claim service-tax exemption for such government road...

Bombay High Court Halts Production And Sale Of Fake 'Gold Flake' Cigarettes

The Bombay High Court has temporarily restrained individuals in Raigad from manufacturing and selling counterfeit 'Gold Flake' cigarettes, following a copyright and trademark infringment suit by ITC Limited. The order will remain in effect until December 10, 2025.In an order passed on November 13, Justice Sharmila U Deshmukh observed that denying interim protection in such circumstances would defeat the purpose of injunction and expose the public to serious health risks.ITC Limited, which...

'Denial Of Relevant Information To Party By Arbitral Tribunal Amounts To Violation Of Due Process': Bombay High Court

The Bombay High Court has held that an arbitral award passed without granting access to relevant documents or materials to one of the parties amounts to a violation of the principles of natural justice and due process. The Court observed that the arbitral tribunal's refusal to supply such documents deprived the party of a fair opportunity to defend its case, thereby rendering the arbitral proceedings fundamentally flawed.Justice Somasekhar Sundaresan was hearing an appeal filed by Iqbal Trading...

Bombay High Court Restrains 'Metro Footwear' from Infringing Metro Brands' Mark

The Bombay High Court has recently restrained Metro Footwear Store from using the mark “Metro Footwear”, ruling that it infringed the registered “METRO” trademark of Metro Brands Limited. The order was passed on November 10, 2025, by a single bench of Justice Sharmila Deshmukh while hearing an interim application alleging trademark infringement and passing off. The court noted that the store repeatedly sought adjournments citing settlement discussions but failed to file a reply, and no one...

'Absence Of Arbitration Clause In Agreement Does Not Render Dispute Non-Arbitrable': Bombay High Court

The Bombay High Court has held that the absence of an independent arbitration clause in a supplemental agreement, when the principal agreement contains an arbitration clause, does not render the dispute non-arbitrable. The Court ruled that a supplemental agreement, merely ancillary to the principal agreement, which seeks to record that the consideration under the Development Agreement stands discharged, is an adjectival element of the substance of the Development Agreement.Justice Somasekhar...

Bombay High Court Restrains Publishers Of “The New Indian Express” From Using The Name Outside Southern States

The Bombay High Court has restrained Express Publications (Madurai) Pvt. Ltd. from using the title “The New Indian Express” outside the southern states for which it was granted rights, holding that the trademark “Indian Express” is exclusively owned by The Indian Express (P) Ltd.A single bench of Justice R I Chagla passed the order on November 13, 2025, allowing the interim application filed by Indian Express. The Court held that Express Publications' use of “New Indian Express” outside the...

Furnace Oil Not On Par With 'Plant And Machinery', Unrelated To Goods Dispatched For Complete Sales Tax Set-Off: Bombay High Court

The Bombay High Court on Wednesday held that manufacturers cannot claim full sales tax set-off on furnace oil used in producing goods that are partly sold within Maharashtra and partly transferred to branches outside the state, ruling that a 6% reduction must apply under Rule 41D(3)(a) of the Bombay Sales Tax Rules, 1959. Assessee sought to put forth that Furnace oil is a consumable used in manufacturing but not part of the finished goods dispatched, and therefore, it cannot be...

Bombay High Court Restrains Local Retail Shop From Infringing 'The Body Care' Mark

The Bombay High Court has temporarily restrained a Mumbai-based retail store from using the name “The Body Care Shop”, ruling that it infringes the registered trademark “The Body Care”, owned by a city-based cosmetics business.A single bench of Justice Sharmila U Deshmukh delivered the order on November 7, 2025, in response to a trademark infringement and passing off petition filed by the proprietor of “The Body Care.”He stated that they have been engaged in the manufacture, marketing, and sale...