Gauhati High Court

Notice U/S 148A(b) Flagging Bogus Transactions Cannot Be Faulted For Merely Mentioning Sale Entry As That Of Purchase: Gauhati HC

The Gauhati High Court has dismissed a challenge to an order under Section 148A(d) of the Income Tax Act, 1961, deeming the Petitioners' case fit for issuance of notice for escapement of income assessment under Section 148. In doing so, it held that the order cannot be faulted merely because the alleged bogus transactions, whose existence the Petitioners (X and Y) did not deny in their reply, were perceived to be that of sale instead of purchase. Justice Devashis Baruah observed, ...

Income Tax Return Is Different From Average Annual Financial Turnover Document: Gauhati High Court Explains

The Gauhati High Court has held that the words “Turnover” and “Income Tax Return” are different and exemption to a bidder from submitting the former in a tender process would not exempt it from furnishing the ITR, for the prescribed years. “The primary purpose of reporting Annual Turnover is to provide a clear picture of a company's revenue-generating capacity. It is often a critical criterion for assessing a bidder's financial strength in tender applications. An Income Tax Return...

TDS Deposited In Wrong PAN By Employer: Gauhati HC Denies Interest U/S 244A Of IT Act, Says It Applies Only When Refund Is Delayed By Dept

The Gauhati High Court has made it clear that interest on refund under Section 244A of the Income Tax Act, 1961 applies only to those cases where refund is delayed by the Income Tax Department. Justice Devashis Baruah thus declined interest to a construction contractor, whose TDS was deposited in the wrong PAN number by the Defence Ministry's Border Roads Organisation. The bench also noted that even if the amount was deposited in the correct PAN number, Petitioner was not entitled to...

If Dispute Is Arbitrable, Court Cannot Refuse To Refer Parties To Arbitration U/S 8 Of Arbitration Act: Gauhati High Court

The Gauhati High Court Bench of Justice Mr. Robin Phukan held that it is also well settled that reference of case to arbitral tribunal under section 8 of Arbitration Act can be declined by the court only if the dispute is non-arbitrable. Brief Facts This appeal, under Section 37(1)(a) of the Arbitration and Conciliation Act, 1996, is directed against the order dated 09.08.2024, passed by the learned Civil Judge (Senior Division), Dibrugarh. It is to be noted here that vide...

Gauhati HC Criticizes ITAT For Inconsistent Views On Applicability Of Explanation To Section 14A Income Tax Act, Says It Applies Prospectively

The Gauhati High Court recently expressed discontent over the Income Tax Appellate Tribunal for taking inconsistent view on the date of applicability of Explanation to Section 14A of the Act of 1961 inserted by Finance Act, 2022. “Such a conduct of the members of an authority, which is discharging judicial functions, cannot be appreciated. Any authority discharging judicial functions is expected to maintain consistency in its views in respect of judicial matters because any unjust...

[Tax Not Paid/ Short Tax] 'Summary Of Show Cause Notice' In GST DRC-01 Not A Substitute For SCN U/S 73(1) CGST Act: Gauhati HC

The Gauhati High Court has held that Summary of Show Cause Notice in Form GST DRC-01 along with an attachment of the 'determination of tax' does not constitute a valid Show Cause Notice (SCN) under Section 73 of the Central Goods and Services Tax (CGST) Act, 2017. “The Summary of the Show Cause Notice in GST DRC-01 is not a substitute to the Show Cause Notice to be issued in terms with Section 73(1) of the Central Act as well as the State Act. Irrespective of issuance of the Summary of...

Retailer Can't Be Presumed To Fall Under 'Exceptions' From GST Registration Without Supporting Materials Placed On Record: Gauhati HC

The Gauhati High Court has held that a retailer cannot be presumed to fall within the exception from registration under the Assam Goods and Services Tax Act 2017, without any materials placed on record to support the exemption. A bench of Justice Sanjay Kumar Medhi observed that though certain entities are given exemption under the Act, there cannot be any presumption in that regard, “more so when the very purpose of the Act of 2017 is to bring all business under the purview of the...

Show Cause Notice U/s 37C Of Central Excise Act Issued At Wrong Address Cannot Be Proceeded: Gauhati High Court

The Gauhati High Court recently held that the recourse to Sub-Clauses (b) & (c) of Clause 37C (1) of the Central Excise Act, is not permitted if the show cause notice was not sent at the proper address of the registered taxpayer.The High Court also clarified that Sub-Clause (b) and Sub-Clause (c) of Section 37(C)(1) of the Act of 1944 can only be pressed into service, if the service of notice under Sub-Clause (a) cannot be affected.As per Section 37C of the Central Excise Act, 1944, any...

“Notification Issued Without GST Council's Recommendation”: Gauhati HC Sets Aside Notification Extending Time Line For Issuance Of Order For A.Y. 2018-19 And 2019-20

The Gauhati High Court allowed the batch of writ petitions challenging the Notification No. 56/2023 dated 28.12.2023 extending the period of limitation for issuance of Order u/s 73(10) of the CGST Act, 2017 for the Assessment Year 2018-19 and 2019-20.The Court opined that the existence of the recommendation is a sine qua non for exercising the power under Section 168A to extend the timelines and without the recommendations, the exercise of the power would be legally not sustainable. The Bench...

“Assessee Entitled To Hearing If Pre-Deposit Is Made”: Gauhati High Court Grants Fresh Hearing

The Gauhati High Court while granting a fresh hearing to the assessee stated that the benefit of hearing has to be given to the assessee as the statutory deposit has already been made by the assessee. The Bench of Justice Arun Dev Choudhury observed that “This court though cannot find fault with the appellate authority in non-entertaining the appeal due to non-compliance of Section 79(5), however this court in exercise of its power under Article 226 of the Constitution of India, in the...

No Element Of Misstatement And Intention To Evade Payment Of Service Tax: Gauhati High Court Quashes Demand & Penalty

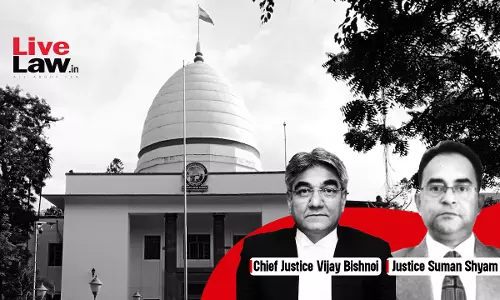

Finding that the Assessee company had provided every detail regarding availment of CENVAT Credit in the ST-3 Returns, and the same was considered by the Central Excise Commissioner, the Gauhati High Court held that the fact of wilful misstatement or suppression should specifically be mentioned in the show-cause notice. Since the Department had not misstated any fact with intent to evade the payment of service tax, the Division Bench of Chief Justice Vijay Bishnoi and Justice Suman...

Purchaser Can't Be Punished For Failure Of Seller To Deposit Tax: Gauhati High Court

The Gauhati High Court has held that a purchasing dealer cannot be punished for the act of the selling dealer in case the selling dealer had failed to deposit the tax collected by it.The bench of Chief Justice Vijay Bishnoi and Justice Suman Shyam has observed that the Department is precluded from invoking Section 9(2)(g) of the DVAT to deny ITC to a purchasing dealer who has bona fide entered into a purchase transaction with a registered selling dealer who has issued a tax invoice reflecting...