Bombay High Court

RERA Authorities Cannot Decide Title Disputes Or Issue Declarations and Injunctions Like Civil Court : Bombay High Court

The Bombay High Court has recently held that authorities and tribunals under the Real Estate (Regulation and Development) Act, 2016 (RERA) cannot adjudicate title disputes between allottees or grant declaratory and injunctive reliefs, ruling that such powers lie exclusively with civil courts. Clarifying the limits of RERA jurisdiction, the court held that disputes concerning the validity of title instruments “is not a matter which the authorities under the RERA are empowered to adjudicate....

SEBI Acted With 'Due Care And Caution' In Clearing WeWork India IPO: Bombay High Court

The Bombay High Court on Monday observed that SEBI had exercised “due care and caution” in clearing the WeWork India IPO, while dismissing two petitions that alleged the regulator failed to act on complaints of inadequate disclosures in the offer documents of the Indian arm of global co-working space brand. A division bench of Justice RI Chagla and Farhan P Dubash said it was “satisfied that SEBI has indeed exercised due care and caution and complied with the legal requirements, including...

Bombay High Court Dismisses Plea Challenging WeWork India IPO, Imposes ₹1 Lakh Cost On Petitioner

The Bombay High Court on Monday dismissed two petitions challenging the IPO of WeWork India, bringing an end to an attempt by two retail investors to stop or modify the company's public issue over allegations of inadequate disclosures.A division bench of Justice R I Chagla and Justice Farhan A Dubash dismissed the petition filed by an invetsor Hemant Kulshreshtha with no order as to costs, while the petition filed by another investor Vinay Bansal was dismissed with a cost of Rs 1 lakh, to be...

“Shall Endeavour” Clause In Construction/Commercial Contracts Can Create Enforceable Obligations: Bombay High Court

The Bombay High Court has observed that the “shall endeavour” clause can amount to an enforceable obligation in the context of construction contracts. While mere failure to achieve revenue projections does not constitute a breach of the “shall endeavour” clause but not making best efforts to achieve projections in the business plan amounts to a breach of the clause. Facts The present petition was filed by Petitioner i.e. Regus South Mumbai Business Centre Private Limited (“Regus”) ...

Designated Committee Must Adjust Pre-Deposits & Investigation Recoveries While Issuing Final Statement Under SVLDRS-3 Scheme: Bombay HC

The Bombay High Court has held that the Designated Committee under the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 (SVLDRS) is mandatorily required to verify and consider pre-deposits and amounts recovered during investigation under Form SVLDRS-3 (final statement issued by the Designated Committee showing the exact amount payable by the taxpayer under the Scheme) A Division Bench comprising Justice M.S. Sonak and Justice Advait M. Sethna, while hearing a writ petition filed...

Income Tax Act | Mechanical 'Rubber-Stamp' Approval U/S 153D Vitiates Entire Search Assessment: Bombay High Court

The Bombay High Court has held that prior approval under Section 153D of the Income Tax Act is not a mere technical or procedural formality, and that mechanical, en masse sanction without application of mind vitiates the entire assessment under Section 153A. A Division Bench of Justice M.S. Sonak and Justice Advait M. Sethna, while deciding a batch of over 60 Income Tax Appeals filed by the Revenue led by Pr. Commissioner of Income Tax Central 4, dismissed the appeals at the admission...

Bombay High Court Grants Interim Relief To 'JIO'; Restrains Taxi Operator From Using 'JIO Taxi' Mark

The Bombay High Court has barred a Jharkhand-based taxi operator from using the name “JIO TAXI” after finding that it prima facie infringes Reliance Industries Ltd.'s well-known “JIO” trademark. A single bench of Justice Sharmila U Deshmukh passed the order on November 24, 2025, granting an ad-interim injunction in Reliance's favour. The restriction will remain in force until December 16, 2025 Reliance told the court that it owns the “JIO” trademark and its variants, with registrations...

Importer Not Liable To Pay Customs Duty On Goods Not Received By Him: Bombay High Court Grants Refund

The Bombay High Court has held that an importer cannot be made liable to pay customs duty on goods that were never cleared for home consumption and were never received by the importer. The Court observed that, under Sections 13, 23 and 27 of the Customs Act, 1962, duty paid in anticipation of clearance becomes refundable once it is established that the goods were short-landed or lost before clearance.A division bench of Justices M.S. Sonak and Advait M. Sethna was hearing a petition filed by M/s...

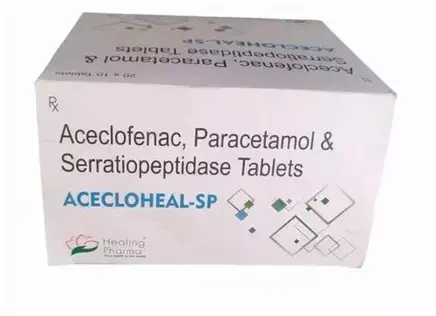

Drug Names Based On International Non-Proprietary Names Cannot Be Monopolised: Bombay High Court Reaffirms

The Bombay High Court has refused to grant an interim injunction to Aristo Pharmaceutical Pvt. Ltd. in its trademark infringement and passing-off suit against Healing Pharma India Pvt. Ltd., ruling that pharmaceutical companies cannot claim exclusivity over trademarks derived from International Non-Proprietary Names (INNs). Justice Sharmila U Deshmukh held that Aristo's registered mark “ACECLO,” taken from the INN 'Aceclofenac', is descriptive and belongs to the public domain, and therefore...

Shilpa Shetty Moves Bombay High Court For Protection Of Her Personality Rights

Bollywood actor Shilpa Shetty has moved the Bombay High Court seeking protection of her personality rights from being illegally commercialised by several known and unknown platforms which are using Artificial Intelligence (AI) version of her voice, deepfake images etc and earning profits.Shetty has highlighted that she is one of the most celebrated and internationally recognised personalities in the Indian entertainment industry for over three decades and is a global icon, considered as one of...

Pre-CIRP Tax Claims Extinguished After Plan Approval, Bombay High Court Quashes Tax Notices To V Hotels

The Bombay High Court has recently reaffirmed that income-tax assessment proceedings for any period prior to the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) stand extinguished once the National Company Law Tribunal (NCLT) approves the plan, ruling that the tax department cannot initiate or continue such proceedings thereafter.A Division Bench of Justice B P Colabawalla and Justice Amit S Jamsandekar observed, “Once a resolution plan is approved by the...

IT Act | Reassessment Cannot Be Used To Review Assessment When All Documents Were Earlier Disclosed: Bombay High Court

The Bombay High Court has held that reassessment proceedings under Sections 148 & 148A of the Income Tax Act, 1961 cannot be initiated to re-open issues that were already scrutinized and accepted during the original assessment, observing that a mere change of mind on the part of the Assessing Officer does not constitute reason to believe nor permit reassessment. A Division Bench of Justice B.P. Colabawalla and Justice Amit S. Jamsandekar, while deciding a writ petition filed by the...