Allahabad High Court

GST Authorities Cannot Assume Jurisdiction For Passing Adverse Orders For Work Concluded Under VAT Regime: Allahabad High Court

The Allahabad High Court has held that GST Authorities cannot claim jurisdiction for levying tax, penalty, and interest on work that was concluded prior to the implementation of the GST Act. Notices were issued to the petitioner, a work contractor, for the Financial Year 2018-19 under the GST Act. The petitioner was unable to reply to the notices in time. Consequently, an ex-parte order was passed, levying tax, penalty and interest on him. Aggrieved, he sought relief before the High...

Predominant Purpose Of Industry Is Essential For Determining Bracket Of Cess Taxation: Allahabad High Court

The Lucknow Bench of the Allahabad High Court has held that in determining cess for an industry, the assessing authority must consider the predominant purpose of the industry. “In this case where the question is whether a particular industry is an industry as covered in Schedule I of the Act, it has to be judged normally by what that industry produces mainly. Every industry carries out multifarious activities to reach its goal through various multifarious methods. Whether a particular...

Income Tax Appellate Tribunal Cannot Pass Ex-Parte Orders Without Recording Reasons For Denying Adjournment: Allahabad High Court

While hearing an appeal under S. 260A of the Income Tax Act, the Allahabad High Court has held that the Income Tax Appellate Tribunal cannot reject adjournment applications and pass ex-parte orders without recording reasons for such dismissal. It was held that if the Tribunal was allowed to do such a thing, it would hamper the right of the parties to a reasonable opportunity of hearing. “While inordinate delays in judicial decision making is not healthy and expeditious disposal of the...

UPGST Act | Lien Cannot Be Created On Assessee's Bank Account After Over A Year Has Passed From Payment Of Tax: Allahabad High Court

Recently, the Lucknow Bench of the Allahabad High Court has held that under the UPGST Act, a lien cannot be created on the assessee's bank account an year subsequent to the payment of taxes. Section 62(2) of the UPGST Act provides that where a registered person submits a valid return within 60 days of the service of the order under Section 62(1), the said assessment order would be considered to have been withdrawn; only the liability for payment of interest would persist. The ...

UPGST Rules | Reason To Believe Must Be Reduced In Writing While Operating Under Rule 86A: Allahabad High Court

The Allahabad High Court has held that while acting under Rule 86A of the UPGST Rules, authorities must record 'reason to believe' in 'writing'. It held that not doing so would be contrary to the purpose of the Rule. “It may not forgotten, granting ITC and maintaining its chain is the soul of a successful GST regime. Therefore, any doubt or suspicion alone may not lead an action by the authorities to block the ITC of the assessee and disrupt the entire value addition chain and...

CENVAT Rules Cannot Apply Retrospectively To Concluded MODVAT Proceedings: Allahabad High Court

Recently, the Allahabad High Court has held that where proceedings under the MODVAT (Modified Value Added Tax) Scheme had concluded prior to the introduction of the CENVAT (Central Value Added Tax) Rules, it would not be open to the revenue department to issue fresh notices against the assessee under the new scheme. The MODVAT scheme, allowing manufacturers a tax credit on input duties, was replaced on 01.07.2001 by the CENVAT scheme. This was later codified as the CENVAT Credit Rules...

Arbitral Award In One Proceeding Can Be Used As Evidence In Another: Allahabad High Court Upholds ₹126 Cr Award To Adani

The Allahabad High Court has held that an arbitral award given in one proceedings can be used as evidence in other arbitral proceedings, though the weightage given to it may vary on case to case basis.While dealing with an arbitral award of more than Rs. 126 crores in favour of Adani Enterprises Ltd., the bench of Chief Justice Arun Bhansali and Justice Jaspreet Singh held“An Arbitral Award, which is placed on record of another arbitral proceedings, can be a highly important piece of evidence....

Compensation U/S 3G National Highways Act Can Be Challenged Under Arbitration Act, Writ Petition Not Maintainable: Allahabad High Court

The Allahabad High Court has held that compensation awarded under Section 3G of the National Highways Act, 1956 can be challenged under the Arbitration and Conciliation Act, 1996 and writ petitions for the same will not be maintainable.A bench of Justice Mahesh Chandra Tripathi and Justice Anish Kumar Gupta held“Section 3G(6) of the Act, 1956 expressly provides that the provisions of the Arbitration Act, 1996 shall apply to proceedings under Section 3G. This creates a complete statutory scheme...

S.238 IBC Is Non-Obstante Clause, Overrides Provisions Of Electricity Act: Allahabad High Court

The Allahabad High Court has held that the Insolvency and Bankruptcy Code, 2016 overrides the provisions of Electricity Act, 2003 read with Electricity Supply Code, 2005.A bench of Justice Arindam Sinha and Justice Prashant Kumar held“Section 238 of Insolvency and Bankruptcy Code, 2016 is a non- obstante clause meaning it grants the IB Code a power of overriding effect on other laws, for the time being in force, or any instrument that is inconsistent with it. This is a Special Section, which...

Allahabad High Court Stays Rs.110 Crore GST Demand On Dabur's Hajmola Candy

The Allahabad High Court on October 10 stayed a ₹110 crore GST show cause notice issued to Dabur India Ltd. over the classification of its Hajmola Candy Tablets.A bench of Justice Saumitra Dayal Singh and Justice Indrajeet Shukla passed the interim order in a petition filed by Dabur challenging the DGGI notice issued earlier this year.The dispute revolves around how Hajmola Candy Tablets should be classified for taxation purposes under the Goods and Services Tax (GST) regime. The DGGI's notice,...

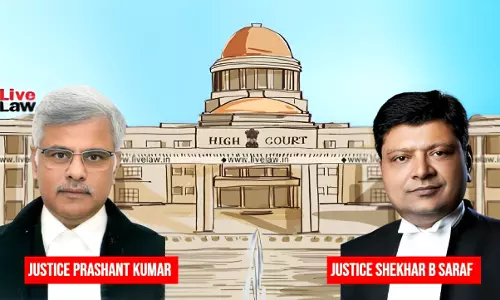

Under SARFAESI & RDB Acts, Dues Of Secured Creditors Take Precedence Over Govt Dues: Allahabad High Court

The Allahabad High Court has held that under Section 26-E of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Section 31B of the Recovery of Debts and Bankruptcy Act, 1993, the debts of the secured creditors will take precedence over all over debts including crown debts.The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar Giri held “Upon a perusal of the judgments cited above, the first principle that emerges is that a...

Taxpayer Cannot Be Left At Mercy Of Assessing Officer Who Chooses To Delay Payment Of Genuine Refunds: Allahabad High Court

While dealing with a writ petition for refund of Tax Deducted at Source (TDS), the Allahabad High Court has held that when the documents for TDS are provided by the assesee, the Assessing Officer must process the refund and cannot delay payment of refund in genuine cases. The bench of Justice Shekhar B. Saraf and Justice Prashant Kumar held “a taxpayer should not be left at the mercy of an Assessing Officer who chooses to delay the payment of genuine refunds. Furthermore, as long as...

![allahabad high court, forced labour, school chowkkidar, minimum pay scale, class 4 employee, 150 rupees per month, Justice Irshad Ali, Amar Singh vs. State Of U.P. Through Prin Secy Education And 3 Ors 2023 LiveLaw (AB) 313 [WRIT - A No. - 1505 of 2004], allahabad high court, forced labour, school chowkkidar, minimum pay scale, class 4 employee, 150 rupees per month, Justice Irshad Ali, Amar Singh vs. State Of U.P. Through Prin Secy Education And 3 Ors 2023 LiveLaw (AB) 313 [WRIT - A No. - 1505 of 2004],](https://www.livelaw.in/h-upload/2023/09/06/500x300_490972-justice-irshad-ali-allahabad-high-court.webp)